Featured

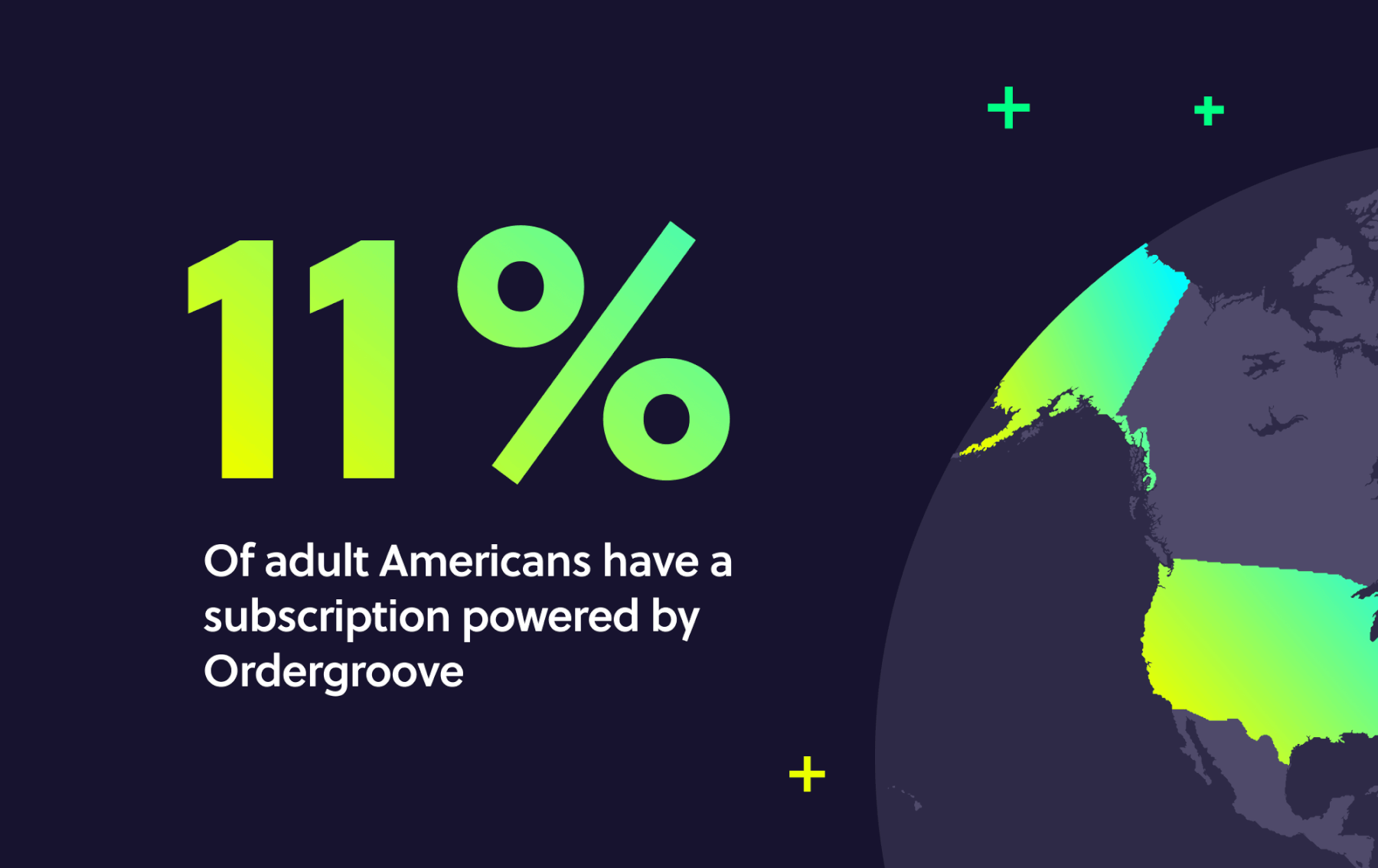

Inside the powerful technology now powering subscriptions for 11% of adults in America

With subscription businesses growing 3.7 times faster than the S&P 500 over the last 11 years — and 53% of consumers around the world predicted to have at least one active retail subscription by 2025 — it’s clear that subscriptions are consumers’ go-to for getting the frictionless experiences they want. The popularity of subscriptions is […]

Read more