Thought Leadership

The complete guide to recurring revenue models for eCommerce brands

When a company needs to increase revenue, two solutions usually come to mind: raise prices or acquire new customers.

There’s nothing wrong with either of these solutions. But raising prices might alienate customers who aren’t yet loyal to your brand — and the 222% increase in customer acquisition costs over the last eight years can quickly eat into your profitability.

The good news is there’s a third way. The recurring revenue model supplies you with a steady, reliable income while giving customers something they want: convenience. According to a 2023 study from Brandwatch that analyzed online conversations about shopping, convenience was the purchasing factor that’s grown the most over the past twelve months, with a 12% increase in mentions compared to the previous period.

The success of a recurring revenue model depends on how well you implement it. In this guide, we’ll show you how to build a recurring revenue model that grows a base of loyal customers who will lift your bottom line. Let’s dive in.

What is a recurring revenue model?

A recurring revenue model is a business model in which a company provides goods or services on a regular basis in return for a predictable revenue stream. Subscriptions are an example of recurring revenue.

What are the benefits of recurring revenue models?

The benefits of a recurring revenue model go beyond a reliable revenue stream. They also include building long-term relationships with recurring customers and investors.

Creates a more stable business model

According to a 2023 study from McKinsey, consumers are sending mixed signals in an uncertain economy — they’re still spending, but 80% are actively “trading down” to lower cost brands.

With so many consumers becoming brand agnostic in the name of savings, recurring revenue models create more business stability. When you have a predictable number of recurring customers buying from you each month, it’s easier to set revenue goals and plan for the future.

Provides a positive cash flow

A recurring revenue model provides businesses with predictable cash flow. This makes an enormous difference when it comes to budgeting resources.

Maintaining a positive cash flow allows businesses to settle their debts and pay their vendors and suppliers in a timely fashion. Companies can also return money to their shareholders, encouraging new investors to get involved in the business.

Encourages customer loyalty

A recurring revenue model doesn’t rely on seeking out new customers. Instead, it focuses on keeping existing customers satisfied. You’ll be able to focus on creating a better customer experience, which in turn boosts customer loyalty — and revenue. Studies show that loyal customers spend 67% more than new customers.

By building up strong communication with your customers, you’ll create a virtuous cycle. Your customers will tell you exactly what kinds of products and services they need so that you can provide them with offerings that meet their needs. In doing so, you’ll build up strong brand loyalty — and you’ll probably get some quality word-of-mouth advertising, too.

This is the opposite of a one-time sales model, where your business deals with frequent customer turnover and expensive marketing efforts. The consistent churn makes it difficult to build strong relationships and get the same level of feedback.

Offsets customer acquisition costs

Acquiring new customers isn’t cheap. Recurring revenue models help you quickly recoup and exceed your customer acquisition costs.

Calculate your customer acquisition costs by dividing the sum you spent on marketing during a certain period by the number of new customers you brought in during the same period. Say your bakery spent $1,000 on advertisements in November, and you brought in 10 new customers; you’ve spent $100 for each new customer.

Now, let’s say each of your 10 new customers signed up for a year-long subscription to your cake of the month club. At $25 a month, that means it takes just four months for the customer to offset the cost of your marketing campaign. And, of course, you’ve also netted a new loyal customer who may soon be interested in your other products.

Before long, you’ll also be able to reinvest some of that new recurring income in customer acquisition and innovation.

Builds investor confidence

Considering that subscription-based businesses have grown nearly four times faster than S&P 500 companies over the last 11 years, it’s easy to see why recurring revenue streams are so attractive to investors.

It can be difficult to attract investors, especially when you’re a small or mid-sized business. That’s because investors are wary of putting money into a company that doesn’t have a proven track record of success.

With a recurring revenue model, you have that track record. According to strategy consultant Robbie Kellman Baxter, “If I want to sell a business to you, if I have a [loyal] subscription customer base, the multiple I use will be much higher – that’s true whether you’re trying to raise money, and it’s true if you’re a small business trying to sell your business.”

What are the challenges of recurring revenue models?

The challenges of a recurring revenue model stem from the need to manage the heightened customer expectations that go with it.

Risk of customer churn

It’s true that a recurring revenue model can minimize customer churn if you’re able to offer a steady stream of value and convenience. But if you don’t listen to your customers and adapt to their evolving needs, the likelihood of churn increases.

According to PYMNTS, 41% of consumers say they would cancel their subscription if benefits like free shipping and control over their orders were taken away — so it’s no surprise that 97% of top-performing subscription businesses make sure to offer features that address those needs.

Say your recurring revenue model focuses on shipping customers their favorite coffee at a discount once per month. Of course, your customers will appreciate the cost savings and convenience of automatic shipments. But what if they want to try a new blend or skip a shipment because of a vacation?

Without investing in educational content to keep customers informed and curious or in the technology to give customers control over their shipments, you risk higher churn rates.

Need for an upgraded technology stack

To provide the convenience, value, and flexibility customers expect from a recurring revenue model, you may need to audit your existing software solutions. Running a successful eCommerce business based on one-off sales doesn’t mean you have the infrastructure to meet these higher expectations.

Say you want to start a subscription business. Invest in a subscription platform such as Ordergroove that makes it easy for customers to subscribe and manage their shipments. Most subscription platforms integrate seamlessly with the top eCommerce providers, allowing customers to opt for a subscription instead of a one-off purchase and choose their shipment cadence.

It’s also important to sync your email service provider with your subscription platform. Subscribers often need a reminder that a shipment is about to go out, so they have the flexibility to skip it if necessary.

Consider investing in an SMS platform such as Attentive for urgent subscription notifications if that’s the channel preferred by your customers.

More complex logistics

Recurring revenue businesses cannot succeed without careful inventory forecasting and warehouse efficiency. To put it in perspective, unsold inventory costs retailers $224 billion each year, and overstocking issues lead to nearly $1.1 trillion in lost sales each year.

Say you run a monthly subscription business that focuses on snack boxes. Subscribers expect those boxes to arrive at regular intervals, which means you need to have sufficient inventory on hand to meet that expectation. But you don’t want too much inventory on hand, especially if the snacks are perishable. Not only are you paying to store the excess inventory, but you also risk losing more money if the products expire.

In addition, your warehouse must have the staff to handle the monthly surges in subscription shipments. Say you go a step further and personalize your snack boxes with thank you notes or special packaging. You may have to pay more to ensure the warehousing teams can assemble the boxes correctly.

Is the recurring revenue model right for your eCommerce business?

Despite the benefits of a recurring revenue model, it’s not suitable for every product or industry. Ask yourself these questions to determine whether the model has potential for your business.

Does your product require frequent replenishment?

Consumable products that customers use regularly, such as diapers, razors, and food products, are good fits for recurring revenue businesses. On the other hand, products you buy once and use over time – such as hubcaps or Dutch ovens – are less likely to succeed.

Does your product have a unique value proposition?

Your product also needs to stand out from the competition. A lower price for the same experience is an option. But if competing on price cuts into your profit margins, you can add value in other ways.

Say you want to launch a diaper subscription. You can differentiate your product by offering different diaper designs or colors or by only selling diapers made from environmentally responsible materials. This approach, paired with a discount, might be enough to set your recurring revenue business apart.

How can you generate recurring revenue?

Given that the average consumer had five retail subscriptions at the start of 2023, it’s easy to see why subscription experiences are the most popular way to generate recurring revenue. But there’s more than one way to go about it.

To choose the best model for your business, consider your product type and industry.

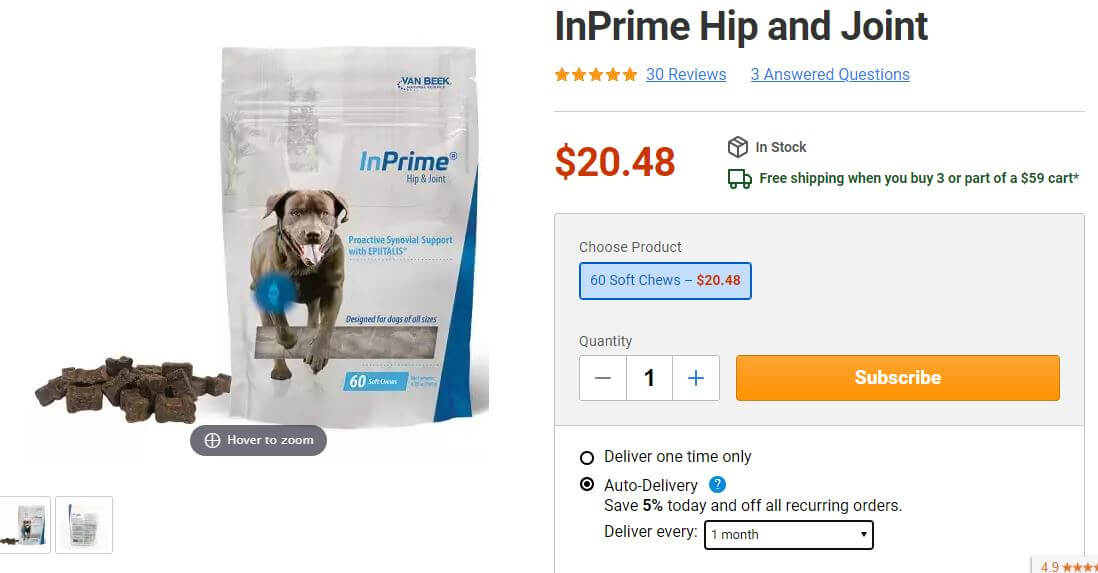

Subscribe and save model

The subscribe and save model provides regular delivery of a product according to a cadence set by the customer. Of all the subscription models, subscribe and save has the least operational complexity, making it the most popular model.

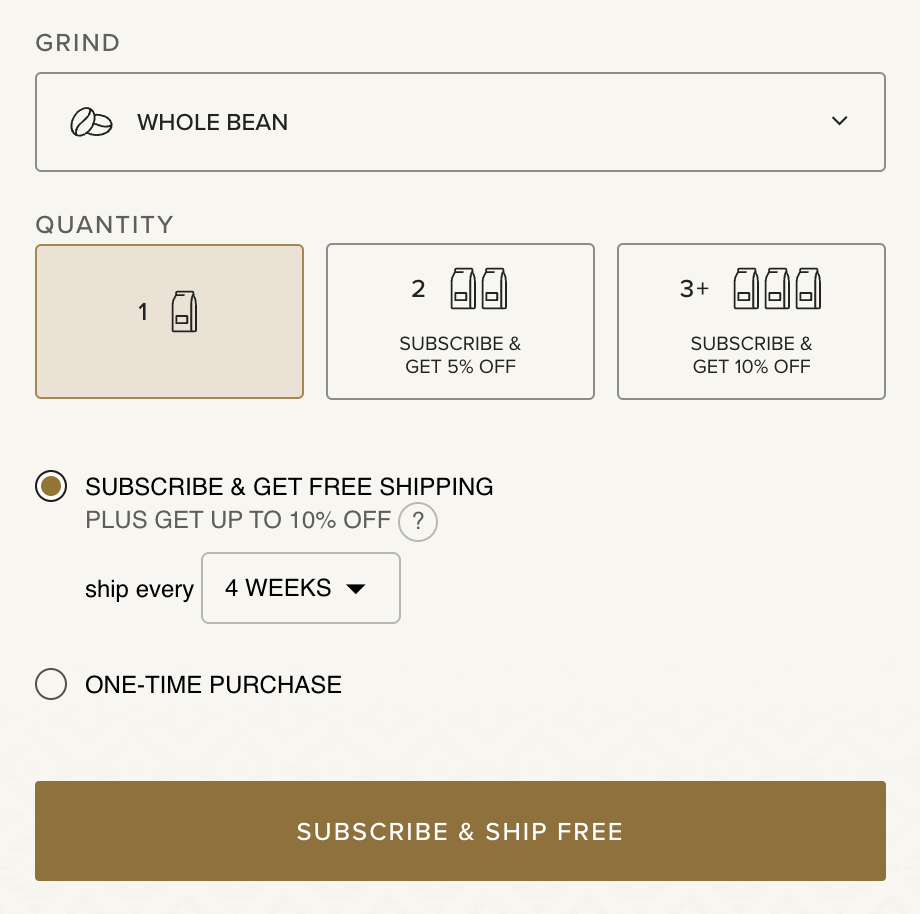

Coffee, cosmetics, and candles are common subscribe and save products. Peet’s Coffee, for example, uses the subscribe and save model to incentivize customers to stock up on more coffee to unlock more savings.

The company clearly outlines the tiered discounts for each subscription option and allows customers to sign up directly from the product page.

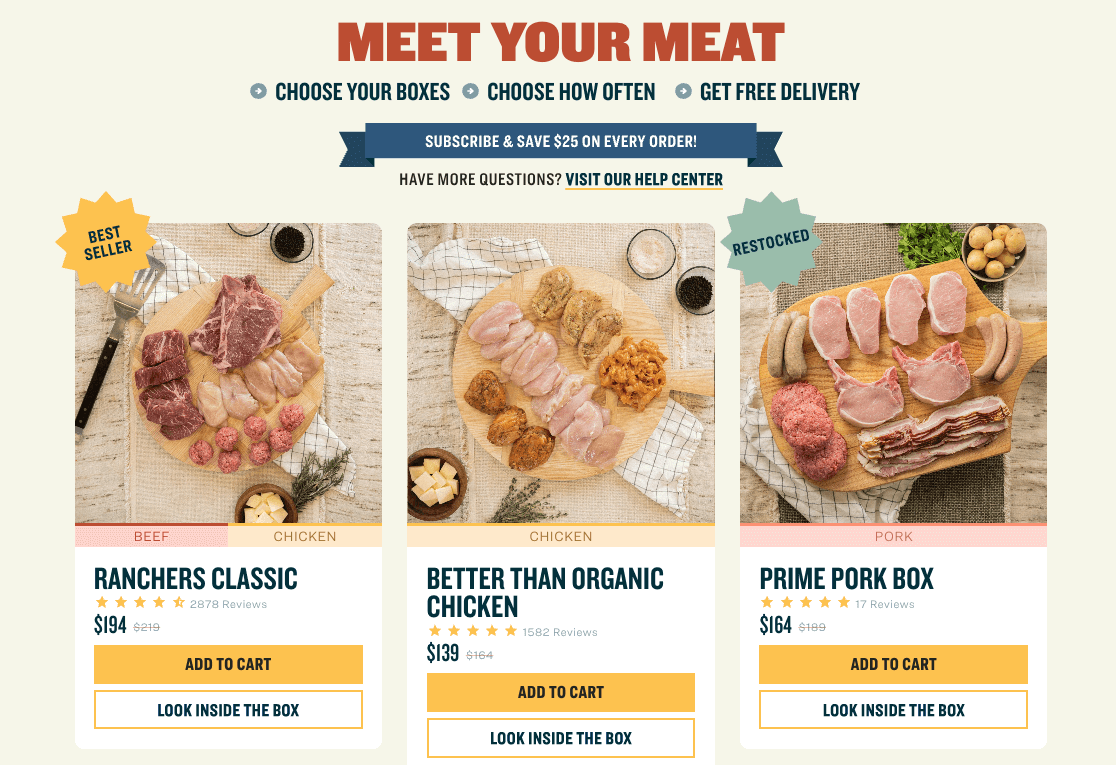

Subscription bundle model

Expanding on the subscribe and save model, subscription bundles are how merchants double down on the revenue potential of product bundles by selling them as a recurring subscription purchase. Often the subscriber selects their own products, but the merchant can too — either way, the result tends to be higher AOV and LTV.

So, it should come as no surprise that so many leading brands and retailers are making subscription bundles part of their core offering — whether as fixed kits, build your own subscription bundles, or rotating clubs with products curated seasonally or sequentially within a specific time frame set by the merchant.

Each type of subscription bundle turns up the novelty dial for subscribers, and that pays off for merchants with better retention on top of the AOV and LTV benefits. After all, subscribers are less likely to churn from overstock on a specific product — or from subscription fatigue in general — when they receive different products in each delivery.

Good Ranchers offers fixed kit subscription bundles of curated meat, chicken, and fish selections to appeal to subscribers’ unique tastes and needs — and sell more products in each recurring order to boost their AOV and customer lifetime value.

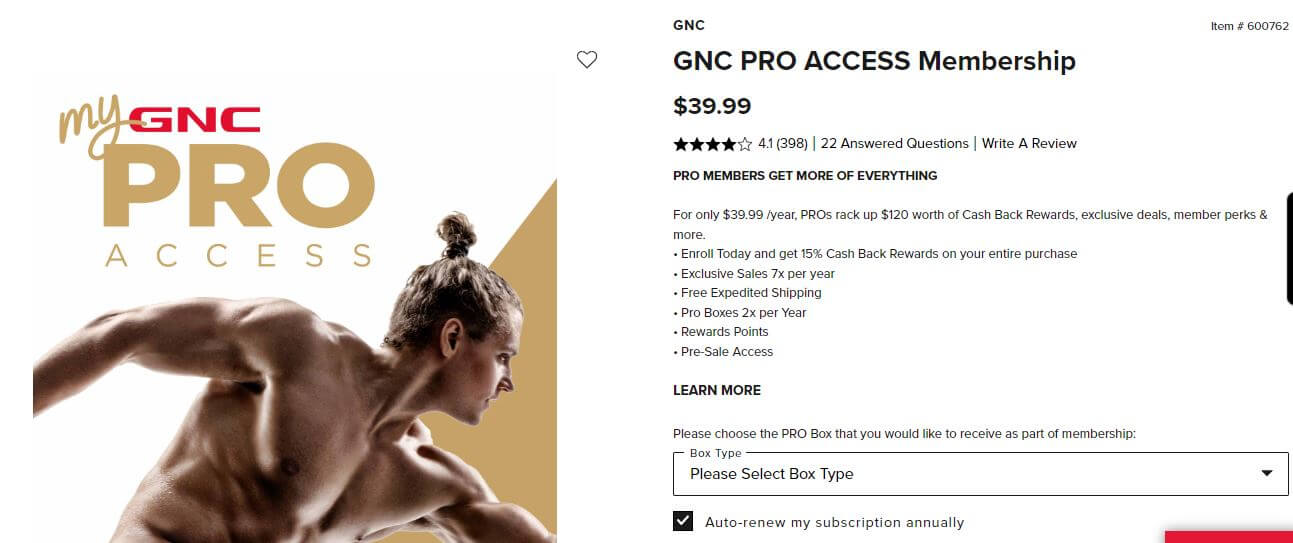

Membership model

The membership model gives consumers access to an organization’s services or privileges for a recurring fee.

Typically, members enjoy a variety of perks. They may get free entry to your location, access to special products, and admission to members-only events.

GNC offers a membership experience that combines elements of curation. Their PRO ACCESS membership offers subscribers two boxes of wellness products per year, free shipping, discounts on additional products, and exclusive sales.

How do you calculate monthly recurring revenue (MRR)?

MRR is a metric that measures whether your monthly recurring revenue is growing or shrinking based on rates of new enrollment and customer churn. It’s often a companion metric of annual recurring revenue (ARR).

MRR is an important metric because it’s a measure of business health. It predicts whether you’ll have enough cash on hand to cover your expenses and invest in growing your recurring revenue business.

Calculate MRR by multiplying the number of customers enrolled in your program by the average revenue per customer. Say you have 3,000 subscribers at the end of the month who spend an average of $35 per month on cosmetics. Your MRR is $105,000.

A rise in MRR from the previous month means you’ve acquired more customers than you’ve lost, while a drop in MRR means customer churn increased. To start combating churn, use a platform such as Medallia to trigger a survey when customers cancel, asking for specific feedback on where their experience was lacking — or a subscription solution like Ordergroove, which offers features to anticipate and prevent subscriber churn.

Best practices for growing eCommerce recurring revenue

Recurring revenue growth depends on incentivizing your recurring customer base to maintain or upgrade their enrollment and add to their monthly orders.

Upsell and cross-sell

Upselling and cross-selling increase a customer’s average order value (AOV) — and we’ve found that adding upsell capabilities alone can increase AOV by 36%.

In practice, it looks like this: Typically, a business will send an email shortly before a scheduled shipment goes out, asking if the customer wants to add products to their order. The email contains product recommendations based on customer preferences and order history, and offers them the same recurring revenue program discount on any additional product they add.

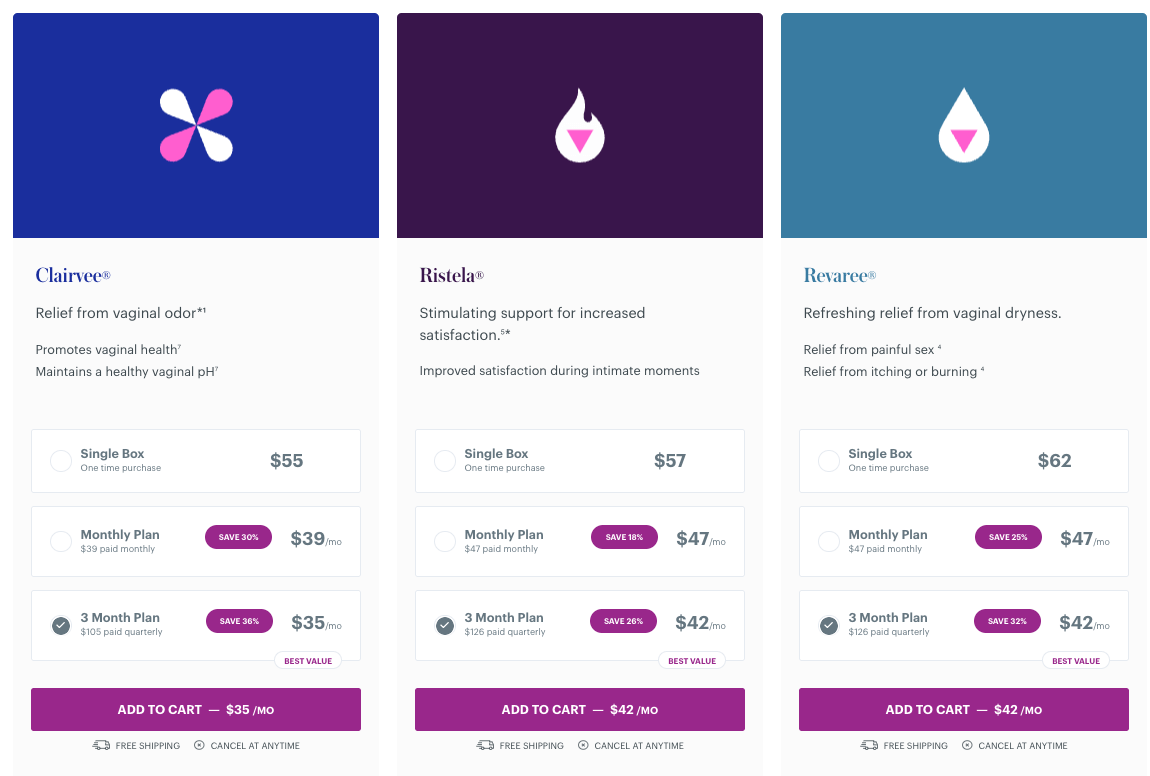

Another upsell strategy is to create multiple recurring revenue pricing tiers, with the more expensive tiers showing more perceived value. Health supplement brand Bonafide does this by offering three billing options.

Ideally, Bonafide wants customers to enroll in the three-month subscription plan, which gives their products more time to reach full efficacy — and more time for customers to make them part of their daily routine. At this level, the per-month revenue is lower than the revenue from a one-time purchase ($35 vs. $55). But the three-month subscription price tag gives the greatest boost to MRR, and the LTV and AOV are immediately higher than the other billing options.

Prioritize recurring revenue programs

Increasing conversions starts by inviting your existing customer base to enroll in the program, highlighting its benefits. Then raise its profile on your website and eCommerce product pages.

Recurring customers have a higher lifetime value than customers who make a one-time purchase, so why not prioritize recurring revenue programs in your marketing efforts? We found that clearly stating the benefits of subscribing gives merchants up to a 150% lift in conversions.

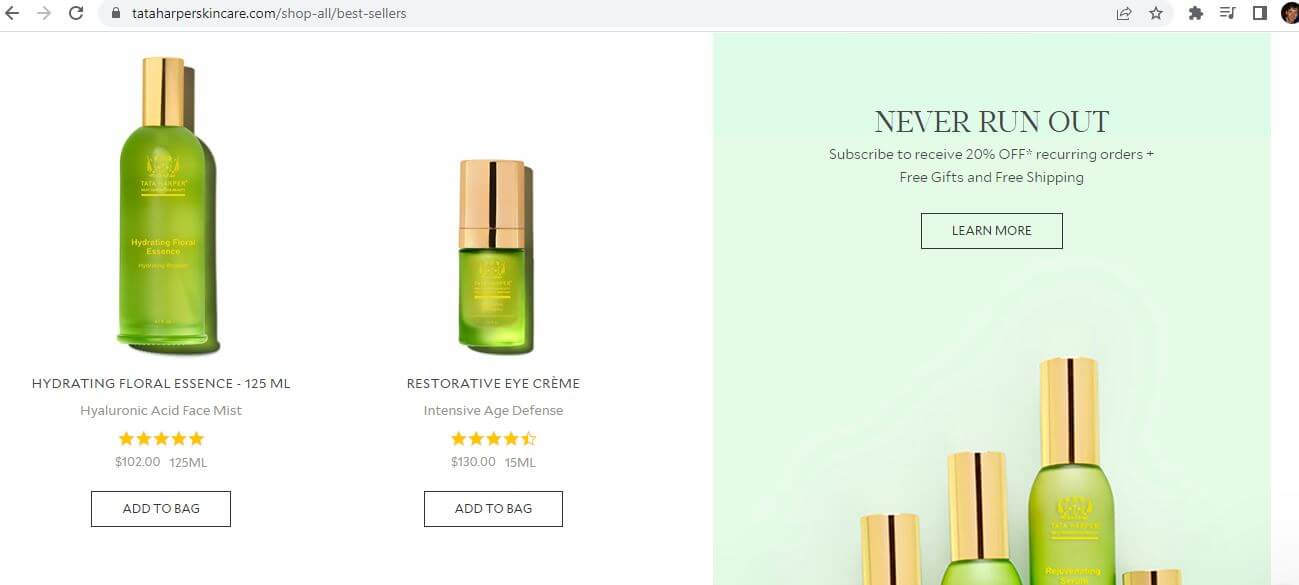

On skincare brand Tata Harper’s popular “best sellers” page, they immediately tout the value of their subscribe and save program with a link to enroll. Visitors get the impression that the recurring revenue program is the best way to enjoy Tata Harper’s products.

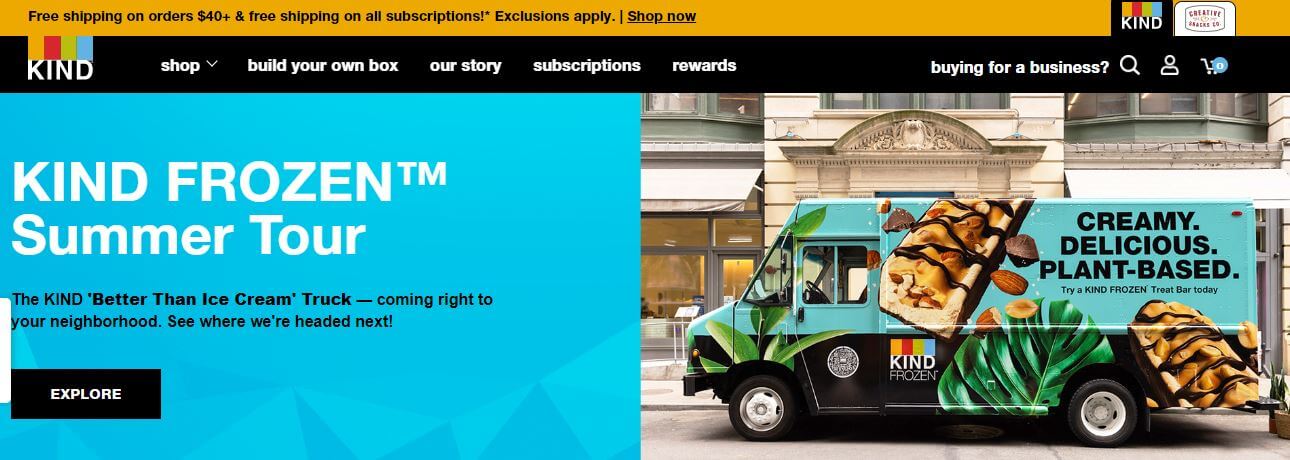

KIND Snacks deploys a banner at the top of their homepage that highlights their subscription offering’s free shipping benefit. They also include subscriptions in their main navigation menu.

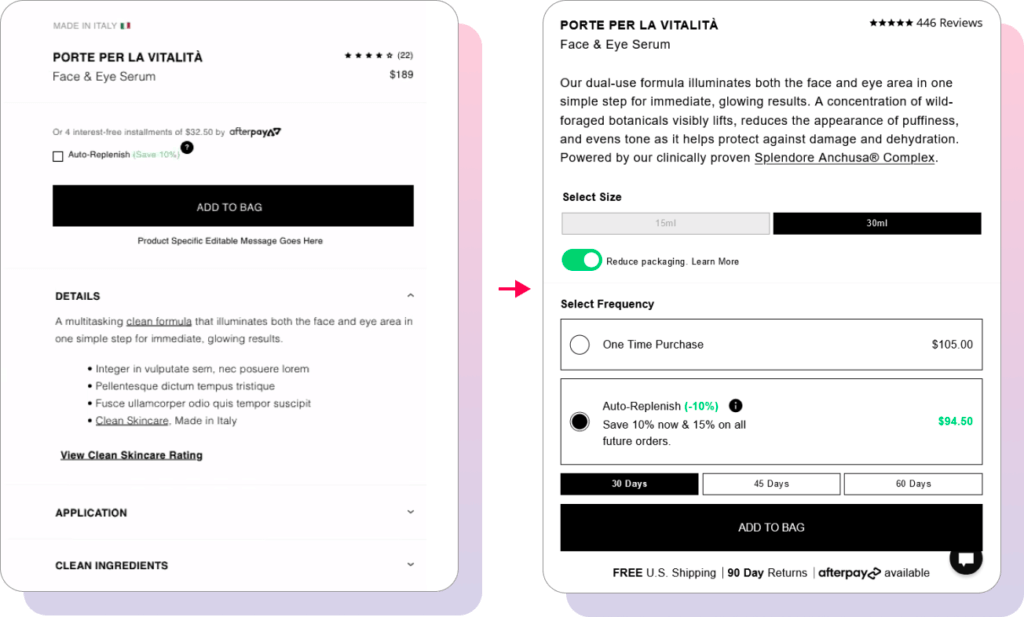

Give subscribers more control

Recurring revenue customers are more likely to stick around – and keep spending – if they can manage their monthly shipments without contacting you. Our research shows that subscribers who can skip shipments last a whopping 135% longer than those who can’t.

Subscription software platforms give recurring customers a portal where they can alter the date of a shipment, swap items out of a shipment, and add products to their order.

After migrating to Ordergroove, Furtuna Skin’s subscriber churn rate dropped 50% — just by making it easy for subscribers to swap products, skip an order, or pause their subscription.

Another key feature of most customer portals is the ability to pause a subscription. Without this option, many customers who need a break due to costs, timing, oversupply, or other factors may feel that churning is their only option. Pausing means losing some short-term recurring revenue, but at least you’ve kept the customer long-term.

Offer retention rewards

Customer retention is a top benefit of recurring revenue models. One of the best ways to achieve it is to reward recurring customers who celebrate enrollment milestones. Retention rewards, we’ve learned, increase subscriber retention by as much as 10%.

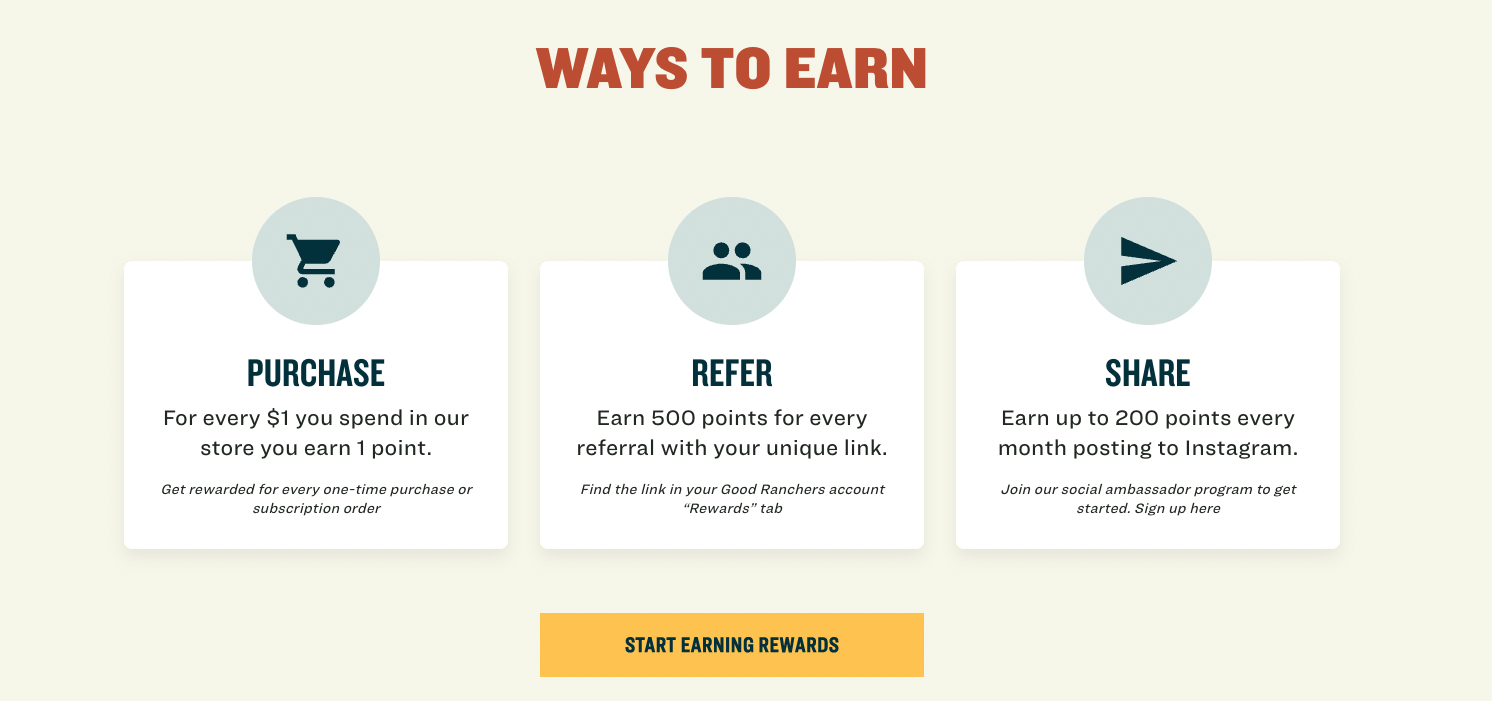

That’s exactly why Good Ranchers integrated Ordergroove with their loyalty program provider, empowering loyal customers to engage with their brand — and even share their subscription experience with friends and family — to earn points to unlock the kind of value that matters most to them.

Their goal is to make it easy for customers to earn points and quickly hit milestones that will get them $25, $50, even $70 off their next subscription box, so customers see that they’re willing to give them something back.

Use recurring revenue to boost customer lifetime value

A recurring revenue model makes customers’ lives easier, which is one of the best ways to deepen relationships with them and grow their lifetime value. Since it’s cheaper to keep a customer than acquire one, recurring revenue is a surefire way to grow your business with the customers already in the fold.

What to know more about subscriptions?

Check out our nine-part guide. It contains everything you need to know to launch and optimize your subscription experience.