Guide

GUIDE

The state of subscription bundles in 2024

Subscription bundles benefits

U.S. subscription businesses have grown 3.7 times faster than the S&P 500 in the last 11 years. And by 2025, 53% of consumers around the world are expected to have at least one active retail subscription, working out to 60% in the U.S. and 46% in the UK.

No matter what’s going on in the world around them, consumers expect seamless and personalized shopping experiences — and they look to subscriptions to get the experience they want.

The subscription economy outlook is promising, but brands focusing on single product subscriptions are up against a low ceiling for average order value (AOV) and, by extension, customer lifetime value (LTV).

The logical solution? Subscription bundles.

The reality? Technology limitations have forced brands into a simplistic bundle offering that fails to maximize their full AOV potential.

At Ordergroove, we’re committed to supporting the world’s top brands with technology that grows alongside them and their subscribers. So, we analyzed the offerings of 205 subscription eCommerce brands to create a snapshot of the state of subscription bundles in 2024 — and identify how brands can break through that ceiling this year, and every year.

But first, some context. Let’s dive into why subscription bundles present a major opportunity in the broader subscription landscape, and break down exactly what that landscape looks like today.

The untapped potential of subscription bundles

Recurring revenue is recurring revenue. So, why aren’t single product subscriptions enough on their own?

For the same reason that selling one product is good, but moving more inventory in each order is better. The answer lies in the LTV to CAC ratio, which measures profitability by comparing the full value of a customer to the cost of acquiring them.

In a perfect world unbridled by rigid subscription technology, brands can use subscription bundles to rebalance the scales of LTV:CAC for profitability by tapping into three major growth mechanisms:

1. To increase AOV is to increase LTV

It’s simple. When subscribers purchase one item per order, AOV and LTV can only grow so much. When customer acquisition costs are sky-high, that takes a toll on profitability in the short term.

Even more importantly, it limits growth in the long term because low LTV means a lower budget for customer acquisition — so, brands can’t grow as much or as fast as they could with higher LTV empowering them to afford higher CAC, and still make a profit.

If customers make a one-time purchase of multiple items? That’s a step in the right direction.

But if they repeatedly buy multiple products — say, in a monthly subscription order? That means a consistently high AOV, and better LTV over time.

2. Subscribers stick around for product diversity

The widespread success of the subscription model proves that convenience matters to consumers. But with so many brands and retailers now offering the convenience of subscriptions, the risk of subscription fatigue is real.

Especially for single product subscriptions, where customers are more likely to tire of (or accidentally overstock) the same product month after month — and eventually churn.

With every subscription promising convenience at the very least, it’s factors like value, personalization, and the overall subscription experience that determine how long subscribers stick around. And that’s a determining factor in their LTV.

Source: Freshpet

Bundles keep subscribers engaged for longer because they tick all three of those boxes. Whether they’re used to give subscribers an entire haul at a lower price, curate products just for them, or remove friction and decision fatigue from the shopping experience, bundles keep subscribers spending more instead of churning.

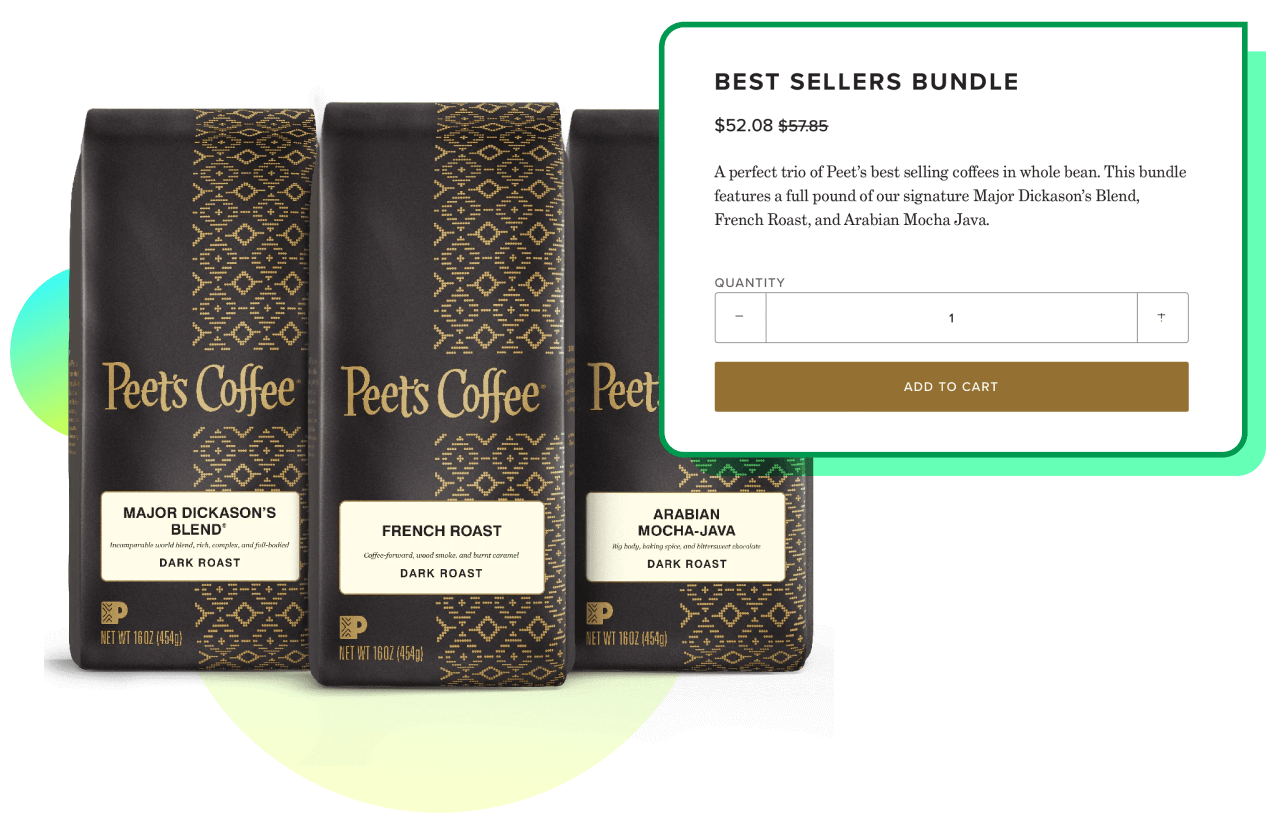

In fact, brands like Peet’s Coffee have seen bundle subscribers place 30% more orders than those who subscribe to just one product over the course of their enrollment.

3. Magnifying the subscription halo effect

We’ve said it once, we’ll say it again: Subscribers are the most valuable customer segment because they spend more across the board.

Our earlier research shows that when customers enroll in a new subscription, they tend to increase their spend with that brand by 60% or more over the six months following enrollment. Even in lower-spending segments, customers who become subscribers eventually level up to the next segment and transform into ever more loyal customers.

Whether it’s because subscriptions make it just as easy to add a one-off item to their next order as it is to stray away to Amazon — or because their subscription comes with kickbacks like deep discounts, loyalty rewards, or free shipping — the net result is a halo effect: Subscribers are the ones who come back to spend more, even outside of their subscription.

And if there’s anything that can magnify that halo effect, it’s bundles. After all, they give subscribers a chance to discover and fall in love with new products they’ll be likely to purchase once — or even subscribe to — in the future.

Now that we’ve unpacked why bundles lead to better AOV and LTV, it’s time to address exactly what bundles look like in the subscription space.

The subscription bundle landscape in 2024

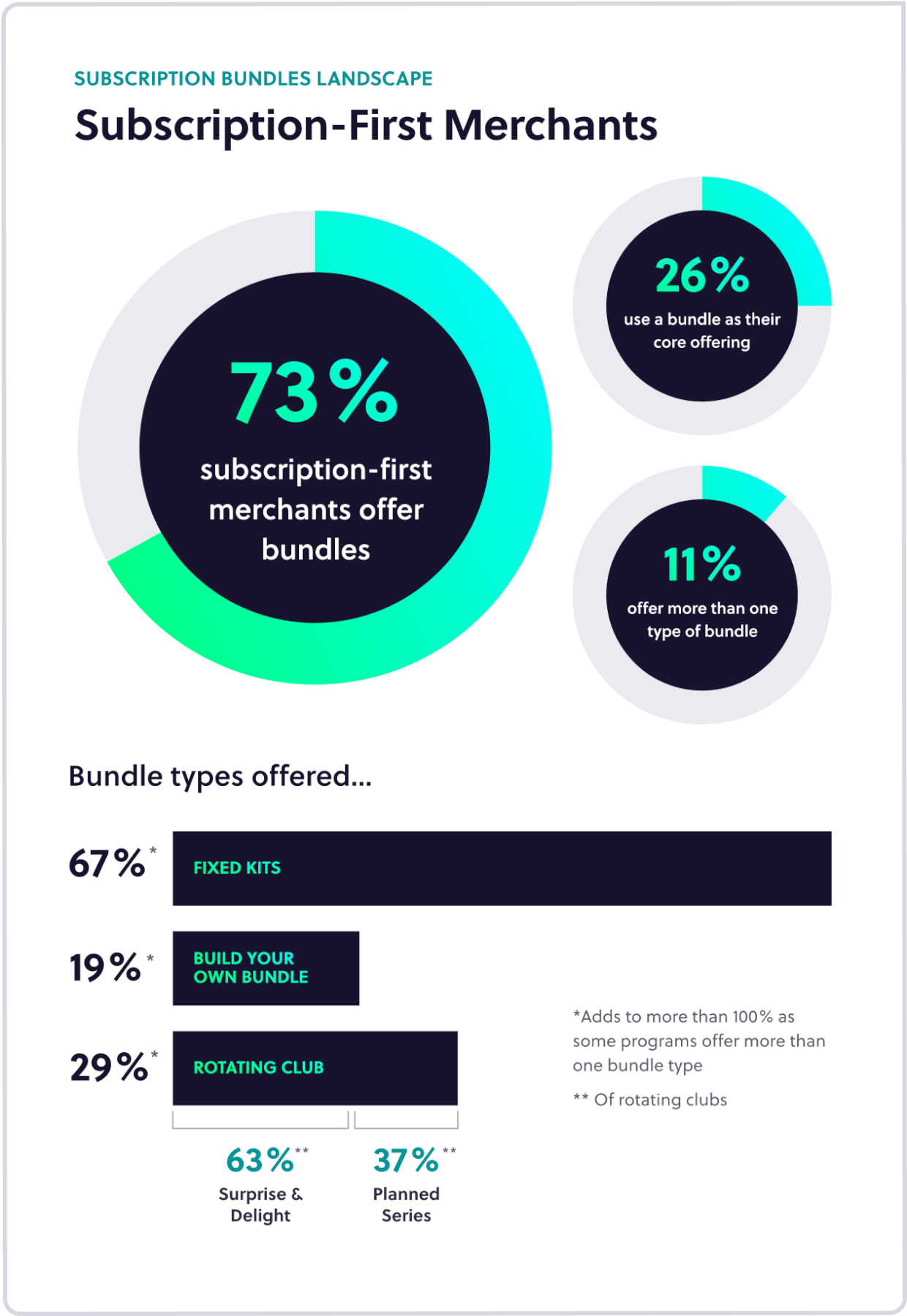

For a snapshot of the subscription bundle landscape as it stands today, we pulled together a list of 205 subscription-first merchants — meaning they generate at least 51% of their revenue from subscriptions — and analyzed their bundle offerings.

Reason being that, as the major innovators in this space, subscription-first brands are a good indication of where the broader market is heading.

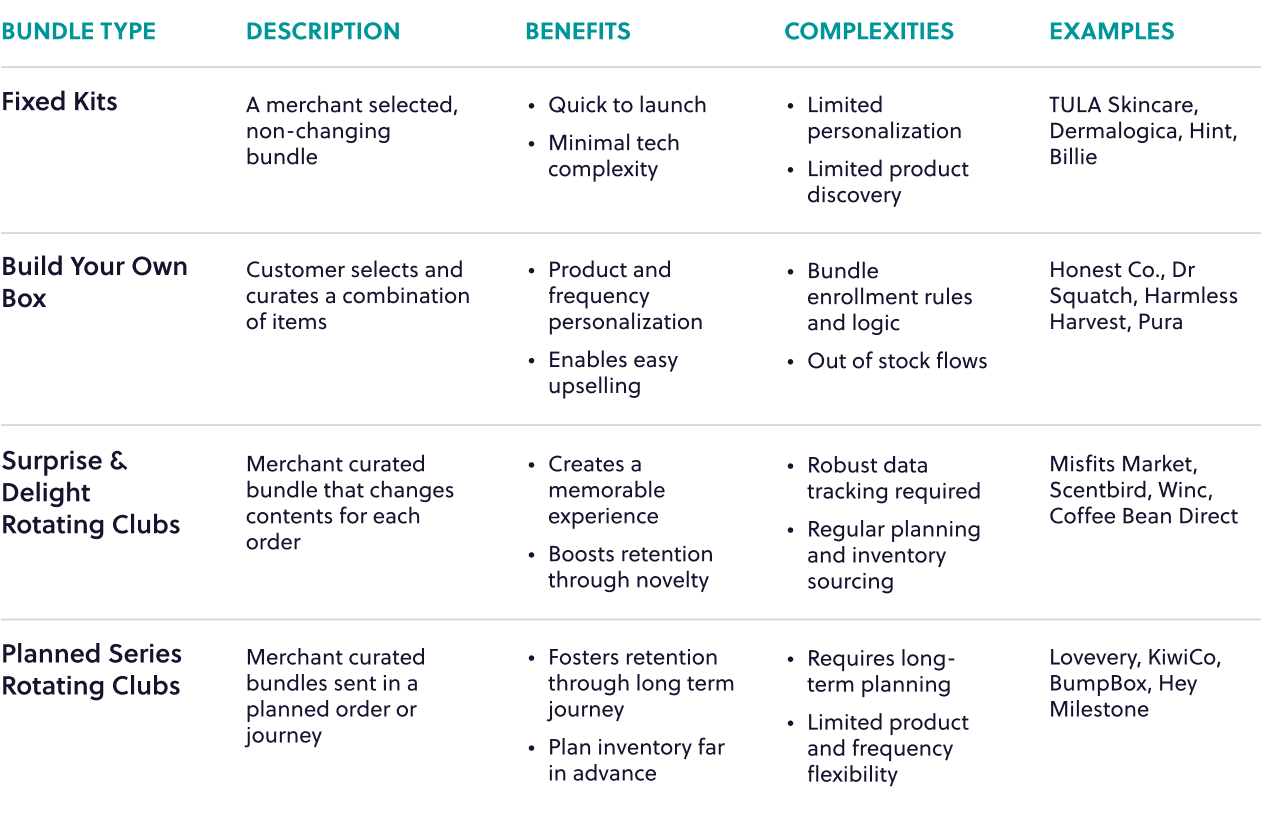

Right now, 73% of subscription-first merchants offer subscription bundles that fall into one of three categories, defined by the level of complexity required for bundle setup, curation, and maintenance — 67% offer fixed kit bundles, 19% offer build your own bundles, and 29% offer rotating club bundles.

Across the board, subscription technology for single-product subscriptions has led to alignment and support of just one of these bundle categories–fixed bundles–since the system and data requirements are similar on the back end. Now, fixed bundles are dominant.

Stick with us for the breakdown below to see the benefits and complexities that come with each type — and why tech shouldn’t make each type mutually exclusive to merchants or subscribers looking to maximize the impact of their bundle offering.

Fixed Kit Bundles

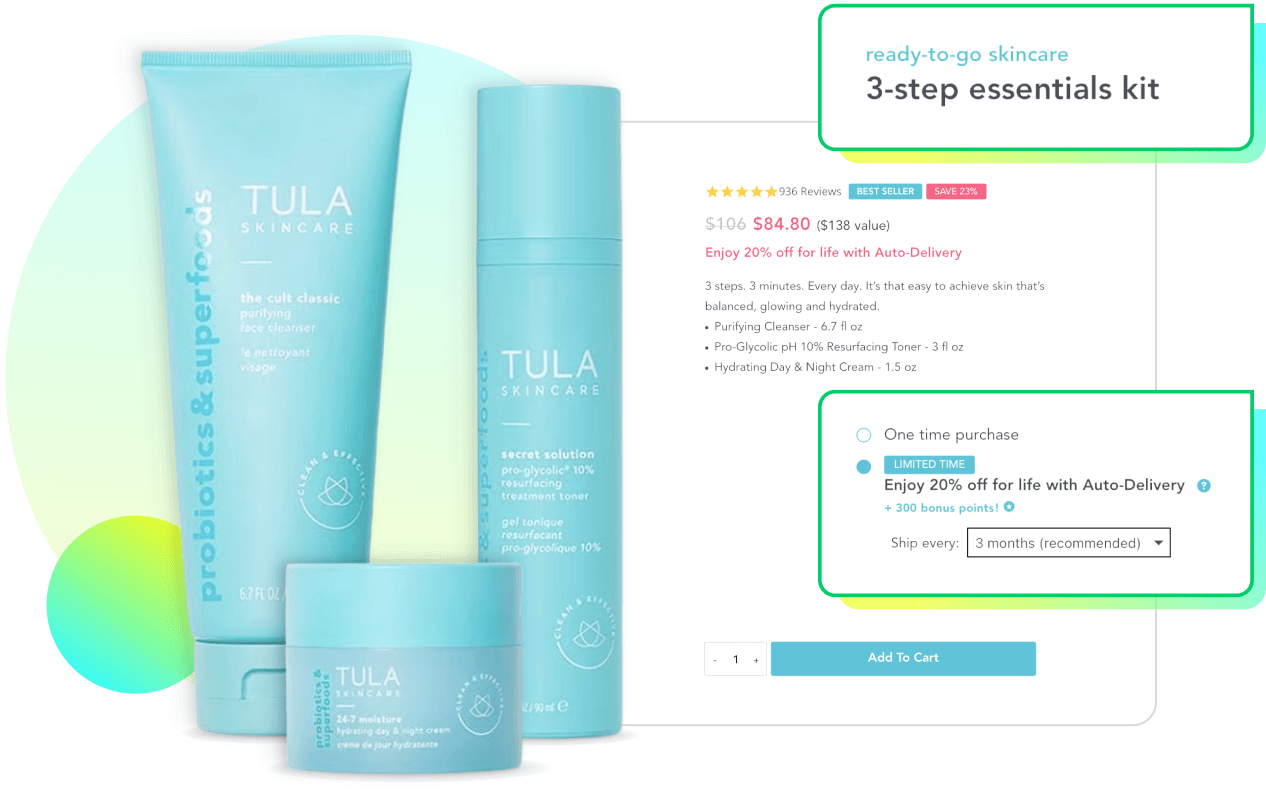

Fixed kit bundles allow customers to subscribe to a group of evergreen products without customization. The items offered in this type of bundle are pre-defined by merchants and listed under a single SKU, so they’re great for brands with limited dev or operational resources.

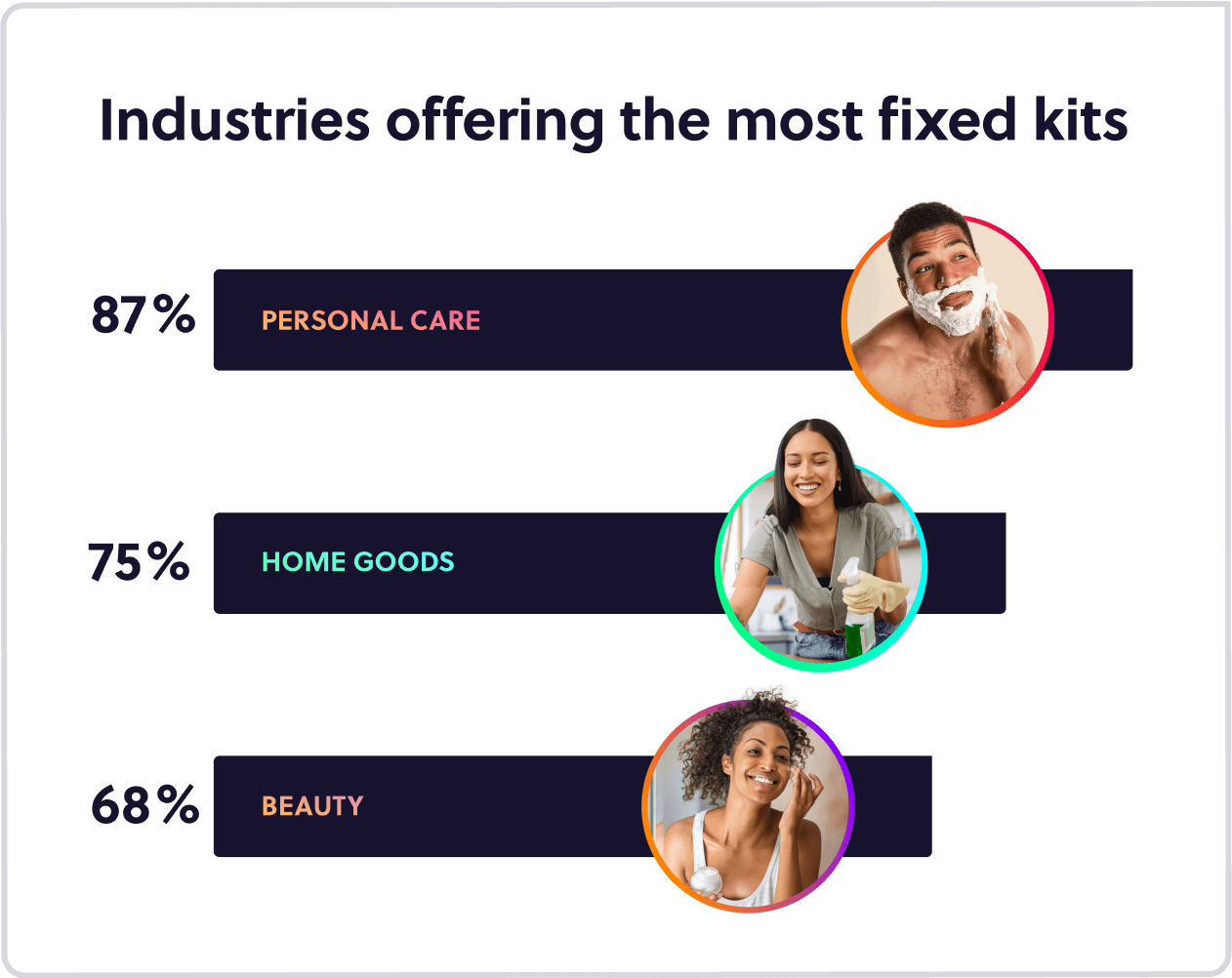

With their many benefits to merchants, it’s easy to see why 67% of merchants offering bundles turn to fixed kits — of the 205 merchants we analyzed, fixed kits are offered by 87% of personal care brands, 75% of home goods brands, and 68% of beauty brands.

They’re the easiest and fastest bundle category to get up and running — and the simplest to maintain over time, requiring minimal operational complexity or additional curation from merchants.

They also come with positive unit economics for merchants — fixed kit bundles ensure that subscribers checkout with multiple products, and moving that extra inventory offsets CAC by raising AOV and LTV.

But there are two sides to every coin. The simplicity of fixed kits means there’s no customization or personalization for the end customer, which can take a toll on subscriber enrollment and retention — the one-size-fits-all product offering in fixed kit bundles can prevent subscribers from enrolling if the items aren’t exactly what they need.

And because subscribers can’t swap out items in the kit if they happen to become overstocked on a specific product, the inflexibility of fixed kits can lead to churn. This inflexibility also limits merchants’ ability to upsell and cross sell to keep growing AOV over time.

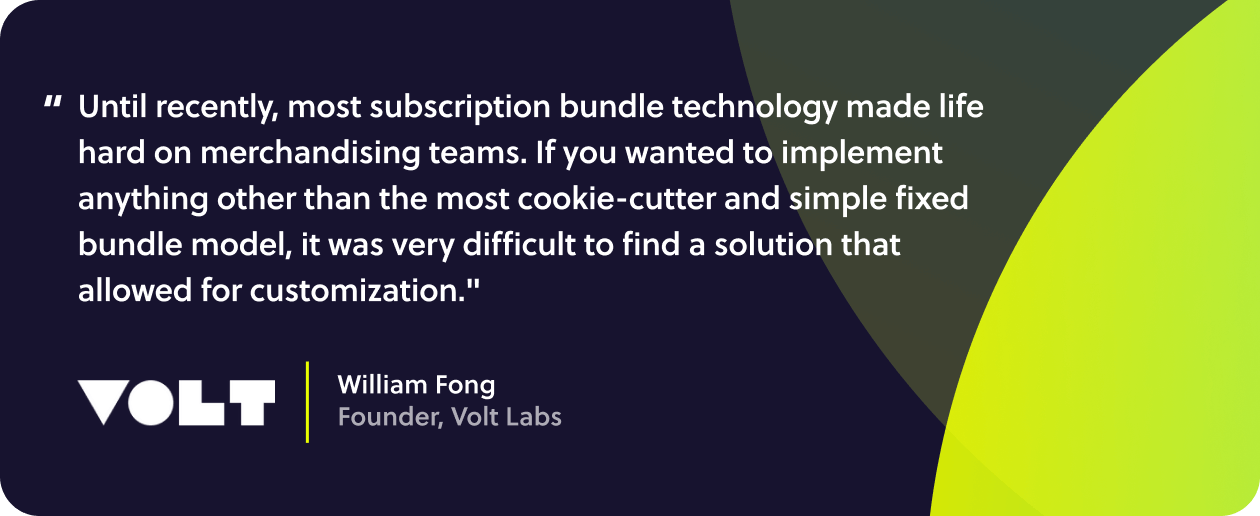

Source: Volt Labs

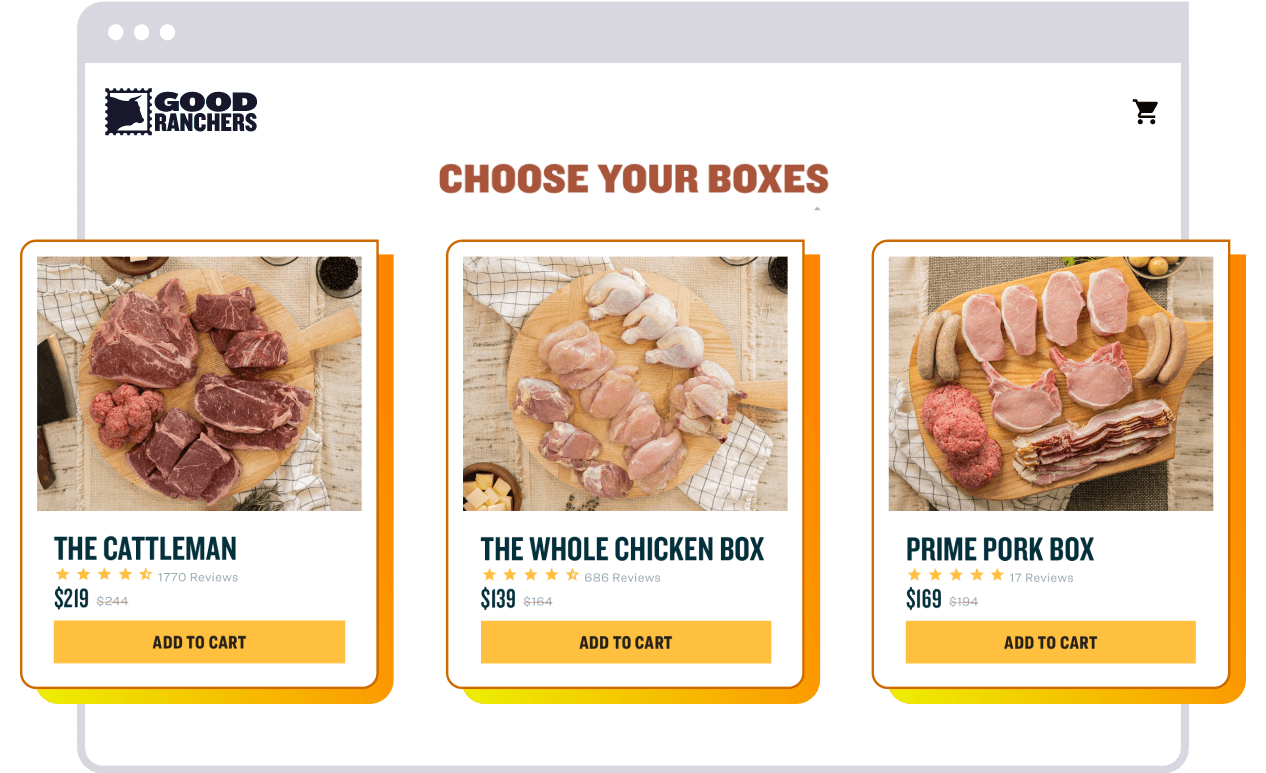

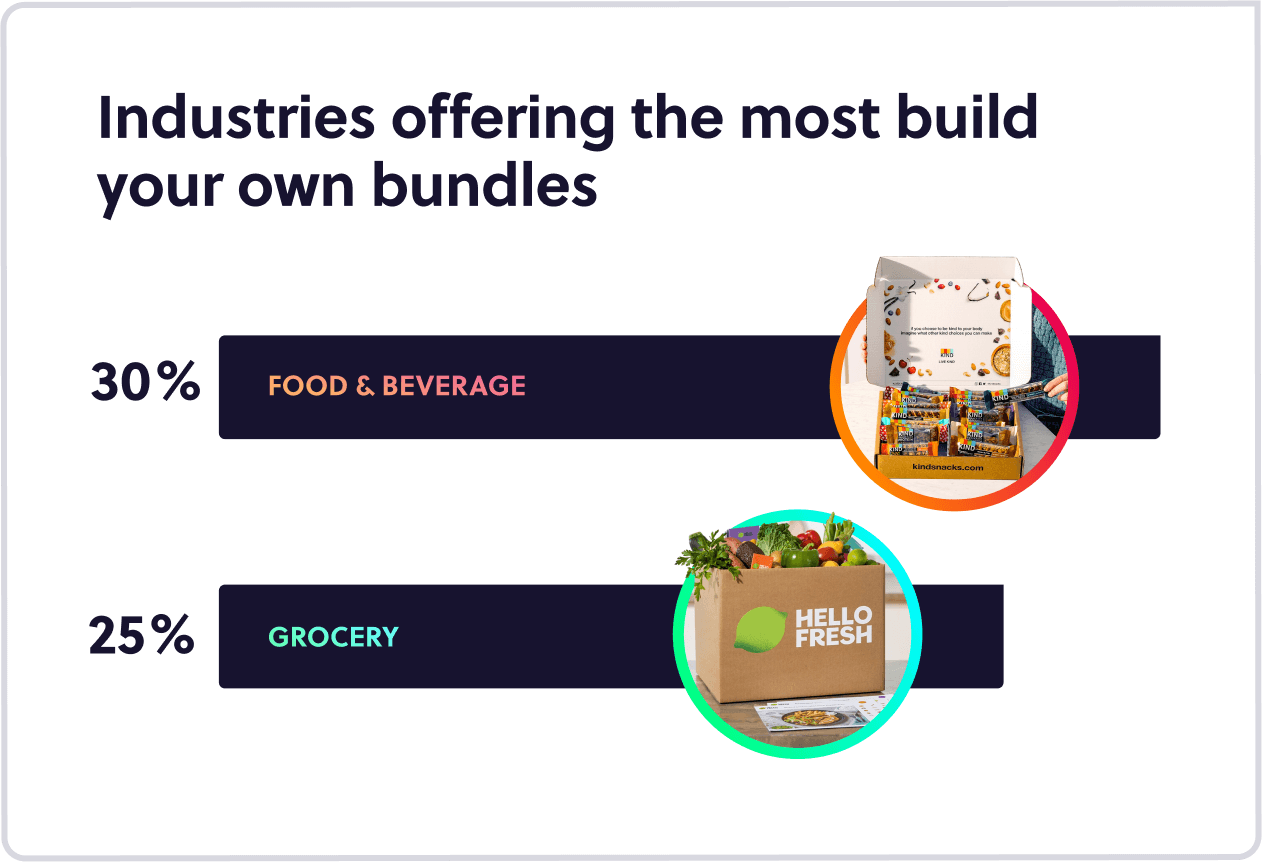

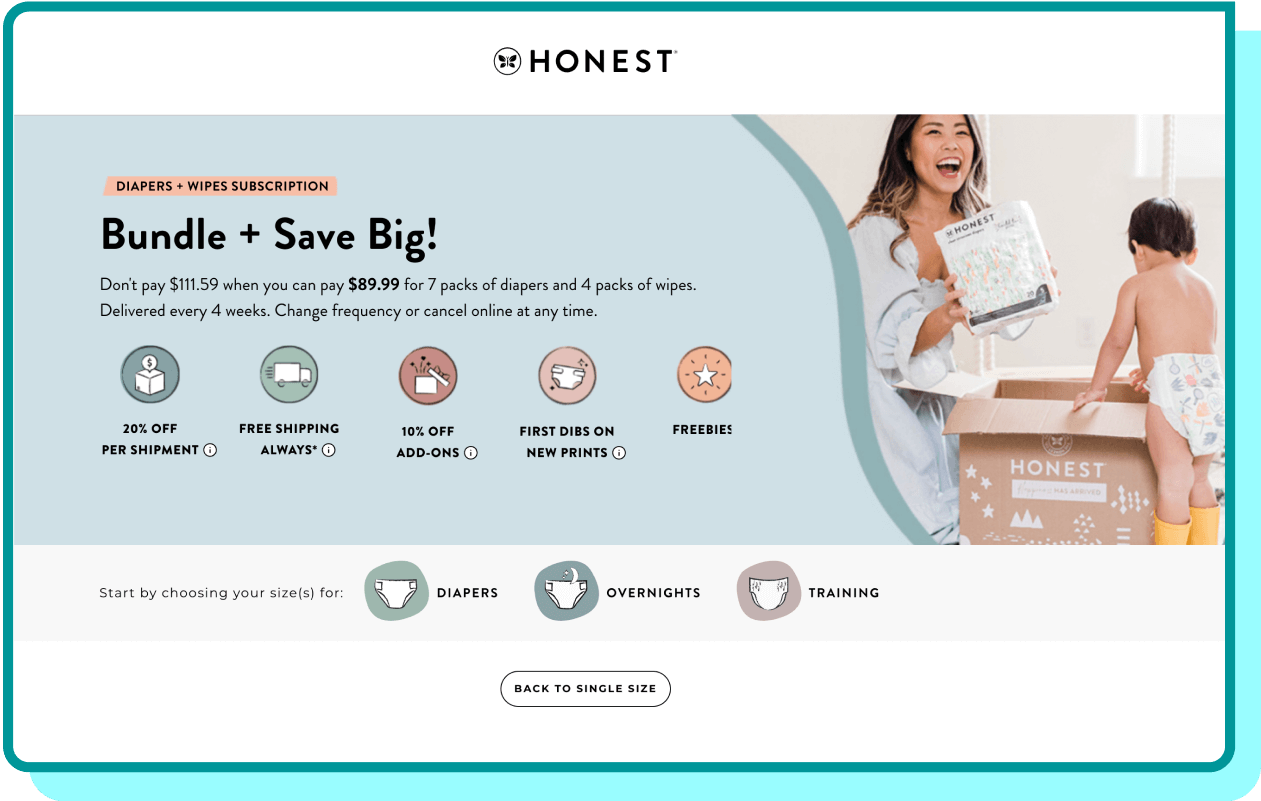

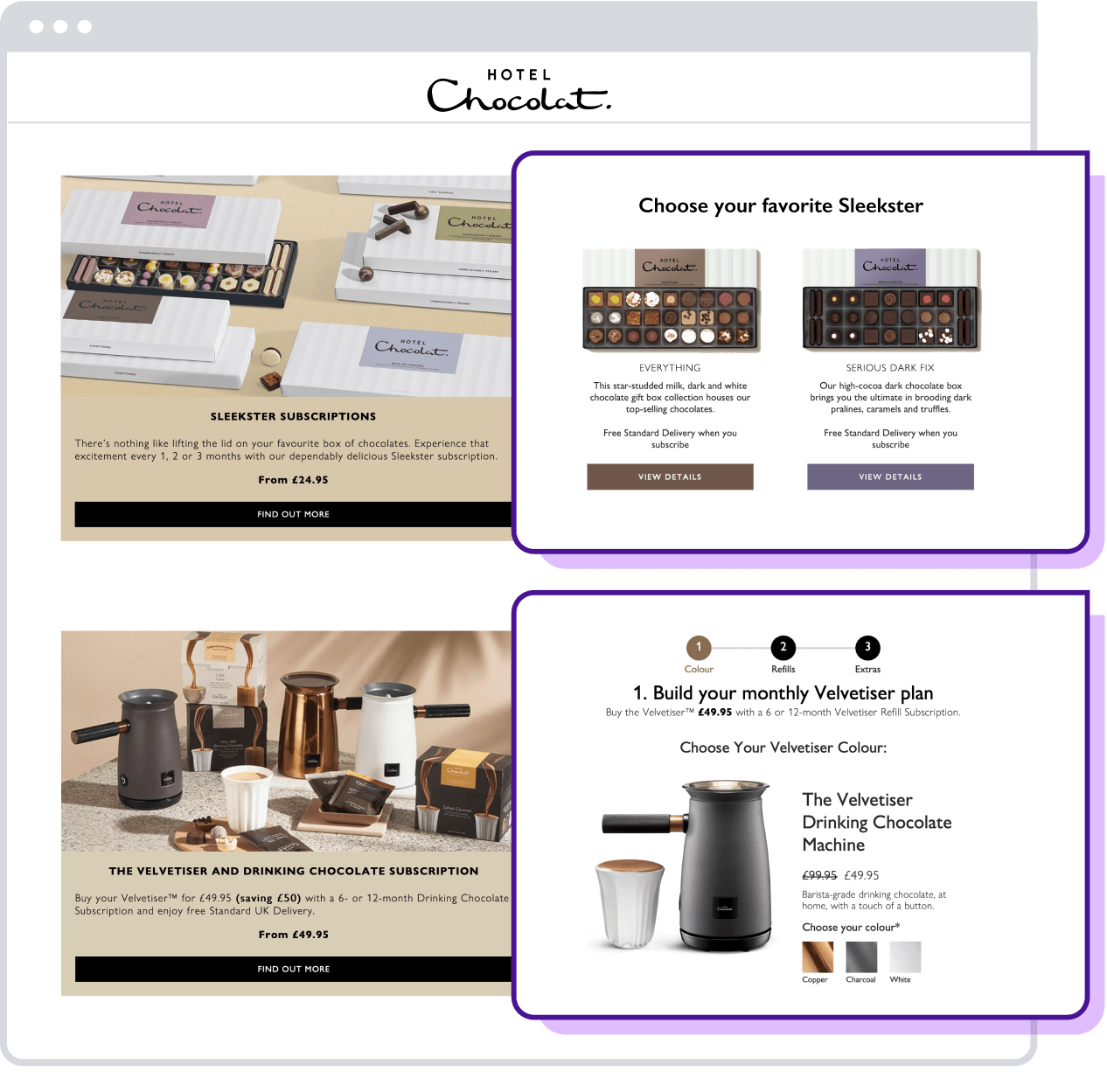

Build Your Own Bundles

On the other hand, build your own bundles let subscribers select their own personalized group of evergreen products from the time they place their initial order, all the way through the lifetime of the subscription.

Of the merchants we analyzed, 19% offer build your own bundles to satisfy subscribers’ need for customization. They’re offered by 30% of food and beverage brands and 25% of grocery brands within the merchant cohort we analyzed — think: HelloFresh.

Build your own bundles give subscribers peak personalization by letting them choose the exact combination of products they want, preventing subscription fatigue and prolonging retention. When subscribers can choose the flavors or quantity they need of a certain product in the bundle, they’re more likely to go through with replenishment instead of churning.

Unlike the other bundle types, they can also accommodate progressive incentives to bundle more items, keeping subscriber AOV up. Think: bundle five products and save 10%; bundle 10 products and save 15%; bundle 15 products and save 20%.

But the flexibility that makes this bundle type so compelling to subscribers also introduces a few challenges. For subscribers, the longer journey of building a custom bundle means they might drop off before completing a purchase. For brands, the number of potential products to account for in each bundle means 3PL logistics and inventory management around things like stockouts become more complex.

First, merchants need to make some operational decisions about their bundle rules and logic (think: eligible product categories for bundles, the number of products allowed from eligible categories, and the total number of products allowed per bundle). Second, they typically have to build a custom landing page like the one below to apply their bundle rules and logic to the shopping experience for subscribers.

The complexity doesn’t stop there. Build your own bundles don’t function as a single SKU on the back end, so merchants have to set up and monitor data for two levels of products — a bundle parent product capturing the number of items bundled, as well as the bundle contents themselves.

The rotating club model

Rotating clubs deliver more novelty to subscribers by delivering a new brand selected rotation of products in each shipment. As the more complex subscription bundle category, rotating bundles are understandably less common, with 29% of the merchants analyzed offering them.

Within the rotating club model, there are two subtypes: Surprise & delight clubs and planned series clubs.

Surprise & Delight clubs

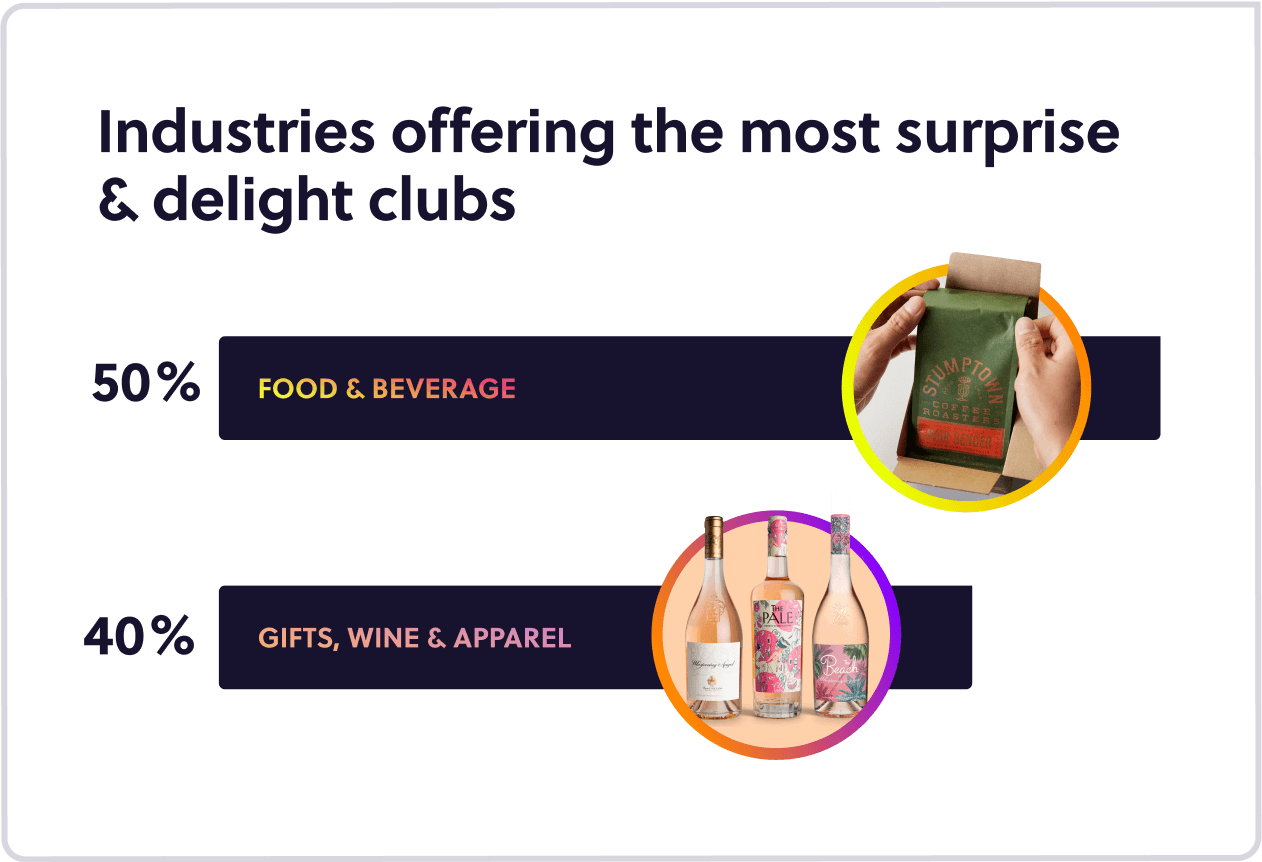

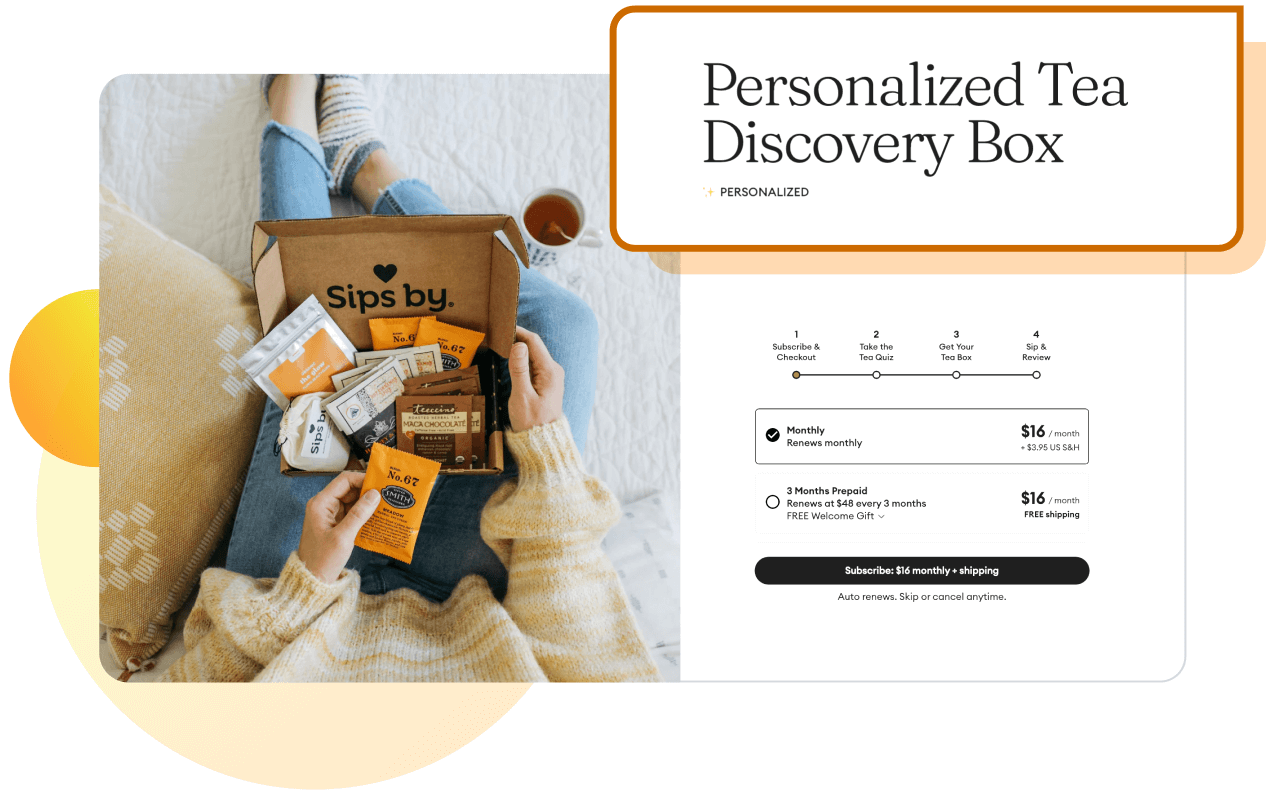

Often referred to as “curation”, surprise & delight clubs give subscribers a chance to receive a curated group of products that are particularly relevant to a certain time of year. Surprise & delight clubs make up 63% of all rotating clubs in the merchant cohort we analyzed — with 50% of food & beverage brands leveraging this model, and 40% of gifts, wine, and apparel brands.

Surprise & delight clubs come with benefits stemming from the curation they enable. By nature, curated product discovery surprises and delights subscribers with a memorable experience — and gives brands a chance to add unique touches to the subscriber experience to build excitement (think: teasing the next shipment with in-depth product information or a backstory about the items in their next shipment).

For brands, those memorable experiences pay off with stronger retention. Subscribers are less likely to churn when they receive different products each month, so surprise & delight clubs can help offset CAC by keeping subscribers engaged over time, growing their LTV.

But that high level of novelty comes at the cost of time and effort for merchants, and flexibility for subscribers. A one-size-fits-all curation also can limit acquisition of subscribers looking for specific items, and fixed send dates can deter subscribers who need more flexibility around when they receive their orders.

On the merchant side, conceptualizing and promoting ongoing surprise & delight offerings can mean more work for merchants — and often requires dedicated staff members planning ahead of each shipment. They also require some heavy data capabilities on the backend to make sure subscribers aren’t receiving the same product twice.

Planned Series clubs

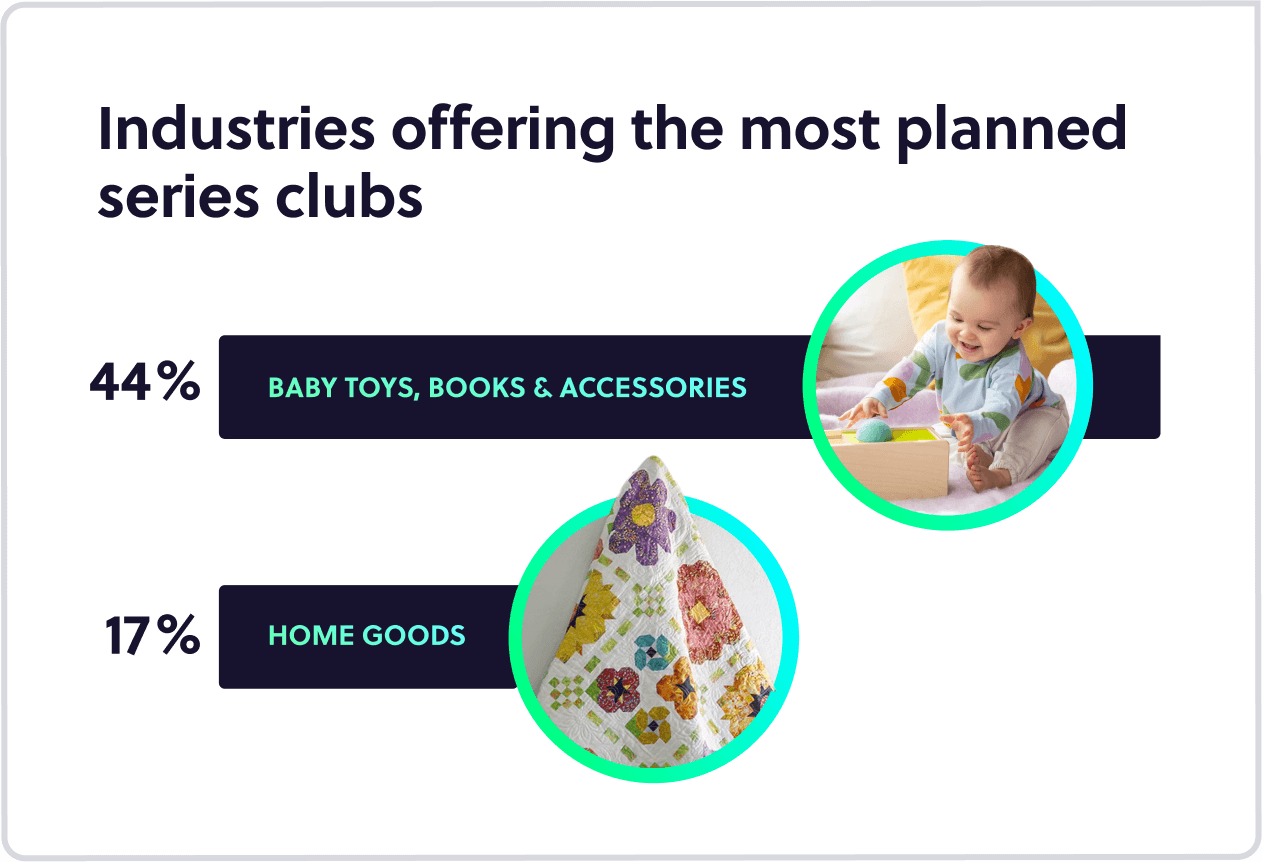

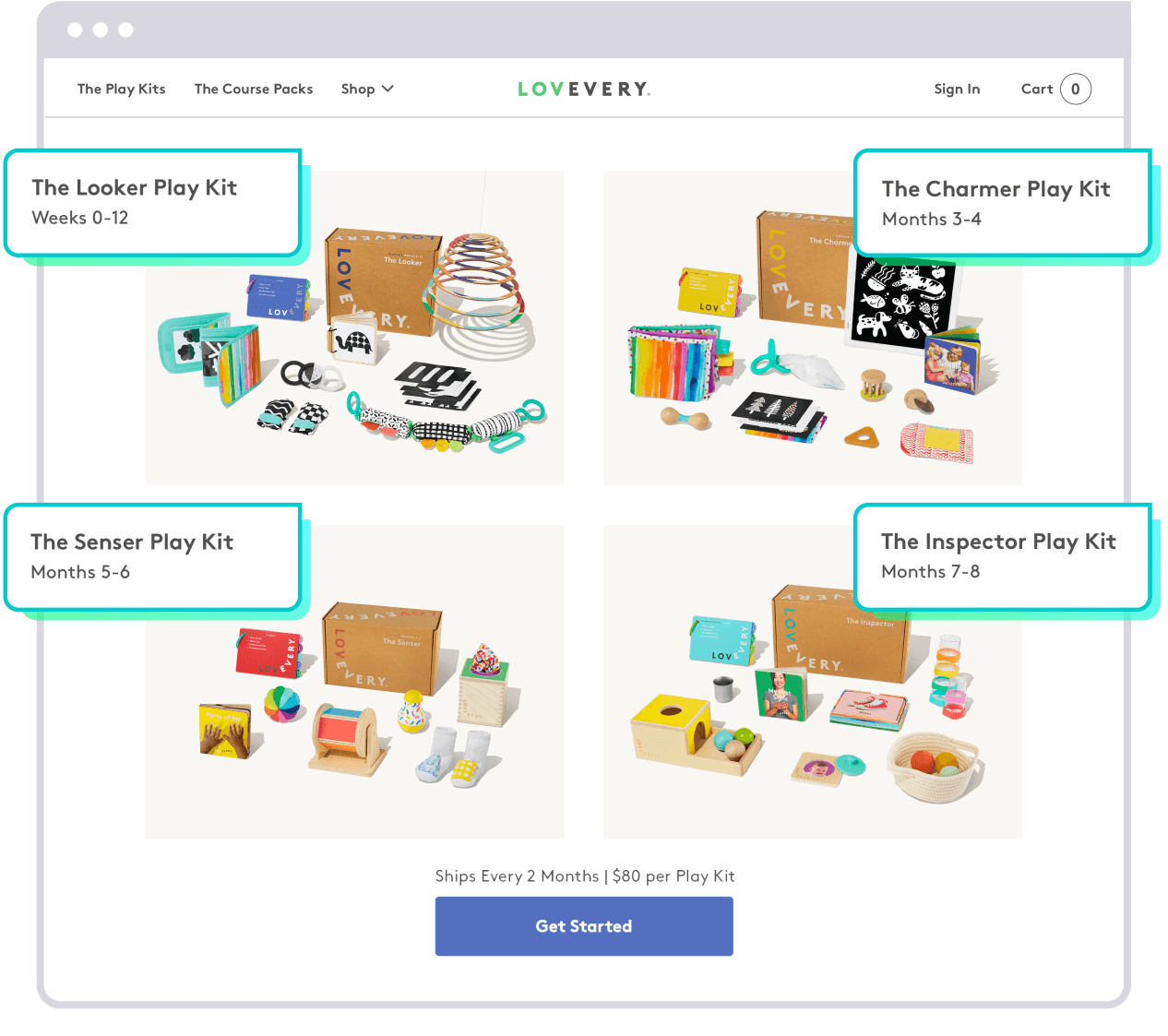

Often referred to as “boxes”, planned series clubs deliver subscribers a predefined journey of products each month, designed to be received in a specific order regardless of when they signed up. Planned series clubs make up 37% of all rotating clubs in the merchant cohort we analyzed; with 44% of baby toys, books, accessories brands and 17% of home care brands offering planned series clubs.

Planned series clubs are the least common of the four types despite the very real benefits they can bring. By nature, they tend to grow LTV through subscriber retention because they appeal to those who expect to stay enrolled in the subscription for longer than a month or two.

And similar to surprise and delight clubs, the phased product curation they entail means the entire journey is planned in advance to the nth degree, so merchants can plan their marketing plays and inventory requirements accordingly.

For example, Lovevery uses planned series clubs to send parents bundles of toys for each developmental stage of their baby. Based on when subscribers enroll, Lovevery can determine how much inventory they need for each developmental stage — and exactly when they’ll need it based on order progression.

That said, the sophistication of planned series clubs does come with a few challenges. Pulling them off requires longer term and more thorough planning than merchants may be accustomed to. And they offer the least flexibility for subscribers, with little to no opportunity to swap products or skip orders.

Table summary of bundle types

The challenge of executing subscription bundles

There’s much to consider when identifying which approach to bundles is right for your brand. The three main bundle categories and their subtypes are just the tip of the proverbial iceberg.

No matter which type you’re considering, subscription bundle execution can come with technological challenges that might explain why some bundle types are more popular among merchants than others.

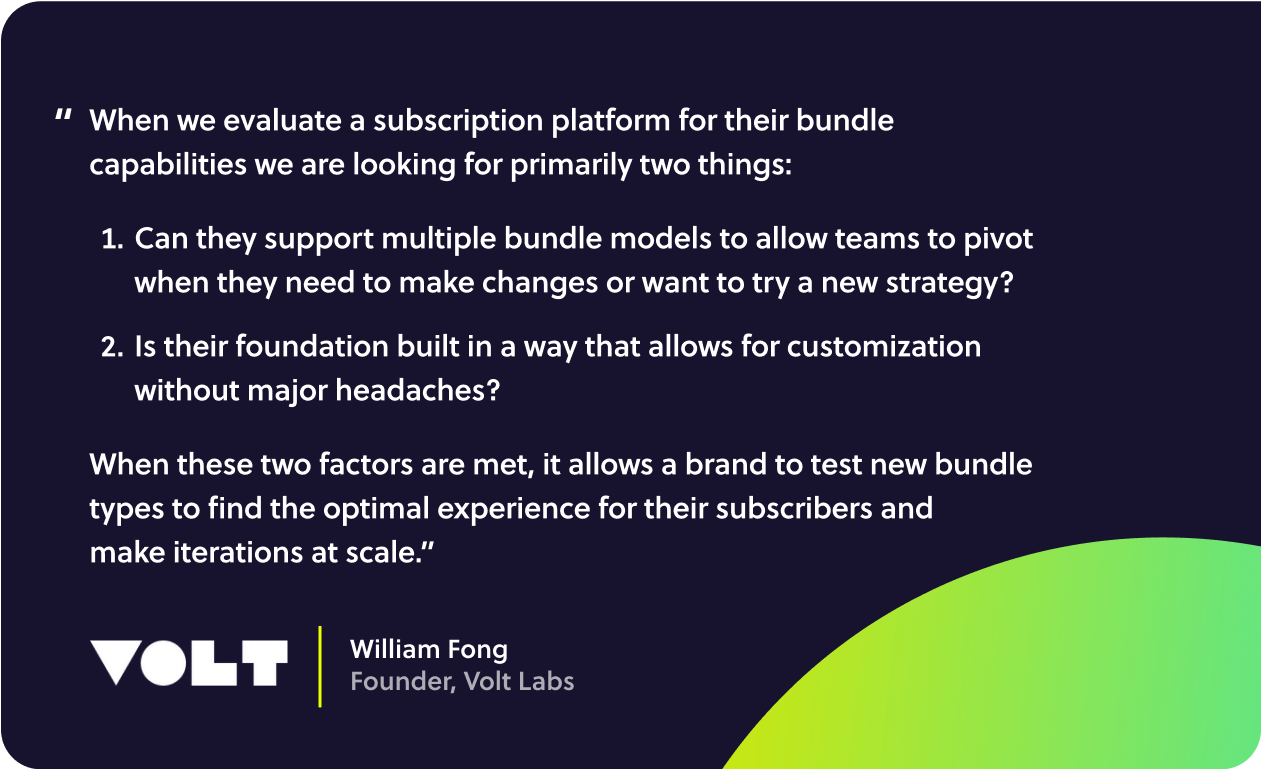

It all comes down to whether your subscription solution is flexible or rigid. If it’s flexible, it supports easy adaptation so you can meet future requirements without new development work. If it’s rigid, it doesn’t easily support ad hoc changes once it’s up and running.

The problem of rigid subscription technology

Rigid subscription technology can pose major limitations on which types of bundles a brand can offer. In fact, most subscription solutions only support only one of the four bundle types, shoehorning brands into a bundle type that doesn’t fit their business needs — or play nicely with any other enhancements they’ve already made to their subscription experience, like offering prepaid subscriptions.

That might explain why only 11% of merchants in our analysis have overcome the shoehorning phenomenon to get more than one bundle type off the ground — and why the 67% majority offer fixed kits, the easiest type of bundle to implement.

Perhaps even more detrimental than shoehorning is that rigid subscription technology also makes it difficult to iterate on bundle offerings as you gather feedback and insights from subscribers.

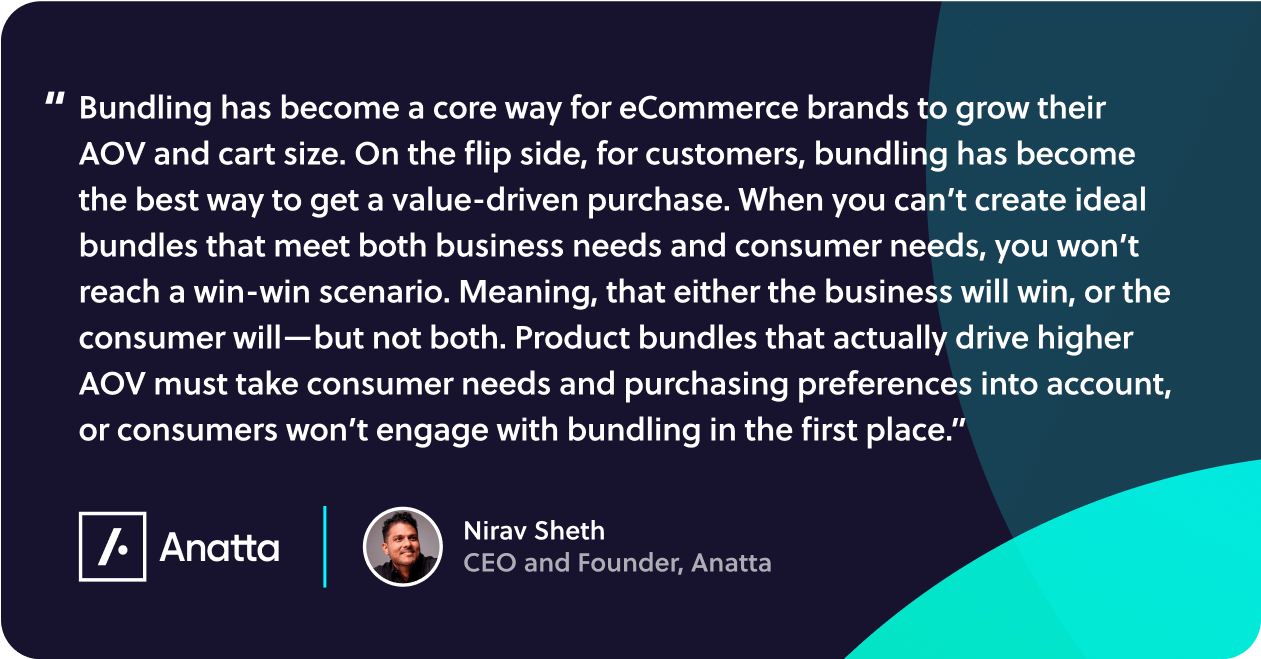

Source: Anatta

Imagine that you used a rigid subscription solution to launch fixed bundles, and six months later you have reams of subscriber feedback indicating that they’d prefer customized bundles. With your rigid subscription solution only supporting fixed bundles — your hands are tied.

Now imagine that you received that same feedback six months after building your own homegrown subscription solution for fixed kits. Technically, you have the ability to rework the subscription tech to support customization — but it would come at the cost of interrupting your roadmap, and allocating valuable time and resources.

The bottom line is that you may be able to identify the optimal bundle experience for your subscribers with rigid technology — but you’ll be hard pressed to implement it.

Flexibility is the secret to successful bundles

When it comes to getting bundles right out of the gate — and ensuring they keep pace with subscriber expectations over time — the key is having flexible subscription technology in your toolkit before, during, and after launch.

Launching a successful bundle program

There are some best practices to keep in mind for a successful launch, and many of them are only possible with flexible subscription technology.

- Test different bundle models before heavily investing in one.

If your subscription technology is flexible enough to support a range of bundle models, you not only have the freedom to try whichever bundle model is popular among competitors in your industry — but experiment with other types that could help you stand out. - Bundles should be compatible with the full subscription offering.

If you offer things like product swapping or prepaid subscriptions to customers subscribing to just one item, those offers should also apply to bundle subscriptions. - Make sure your warehouse, systems, and internal teams are prepared for launch.

Whether you’re testing out a few models or committing to one, launching bundles will affect any teams or departments looking after your inventory, eCommerce platform, marketing, and so forth — and they all have to be kept in the loop for a smooth launch. When in doubt, it’s always wise to start with a bundle of your best selling products that you know you’ll have inventory for. - Plan for your bundle offering to evolve over time.

When 95% of execs believe their customers are changing faster than they can change their business, the ability to respond rapidly to subscriber expectations is a competitive advantage. With flexible subscription technology, you can meet subscribers where they are with your bundle offering — and be part of the 5% that’s able to rise to the occasion.

Source: Volt Labs

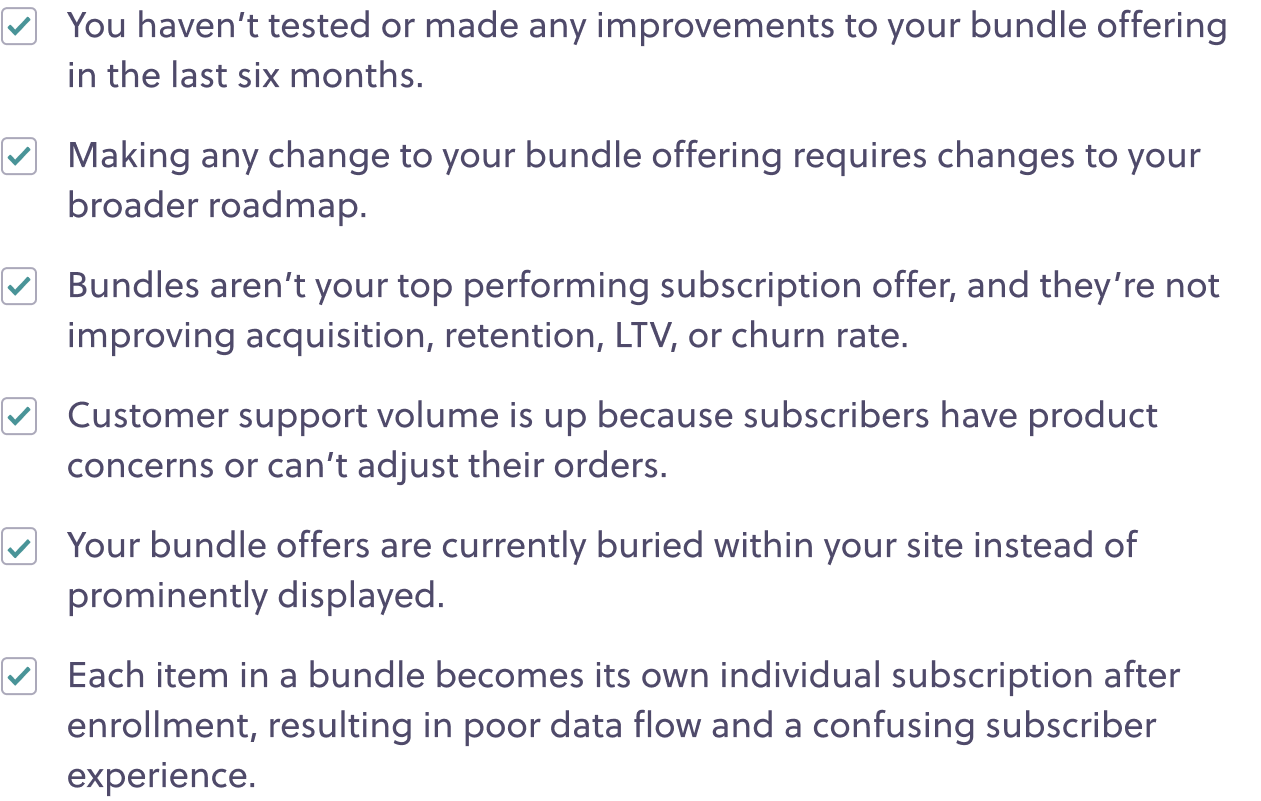

Signs your subscription technology isn’t flexible enough

If any of the below sounds familiar, rigid subscription technology may be holding you back.

If you found yourself ticking a few of those boxes, it’s time to talk to your internal tech lead or agency partner to get a full understanding of the limitations you’re currently facing so you can look for a more flexible solution going forward.

Bundles: the future of subscriptions in 2024, and beyond

We’ve established that bundles are a huge opportunity for subscription-first brands.

And that flexibility for brands and subscribers alike is a key ingredient in successful subscription bundles.

Whether you offer them today or you’re weighing your options, these expert predictions will inspire you to get in on the ground floor of world class bundles, powered by flexible subscription technology.

Subscription bundles will go from side project to primary go-to-market strategy

Bundles are hardly a requirement for offering a subscription experience. Until recently, they’ve been a nice-to-have — and a promising side project for the brands that offer them.

Over the last ten years, customer acquisition costs have jumped 222%, squeezing profitability and leaving brands to find new ways to reliably improve AOV and LTV — while still delivering the value and personalization customers expect. To that end, the subscription model has proved highly effective — and bundles are how front-running brands are taking that subscription success to the next level.

Now that major eCommerce platforms are taking notice and are leaning into bundles by making them a native functionality, it’s safe to say they’re on the fast track to becoming a must-have that subscribers expect to see as a purchasing option.

And, going forward, more brands will put subscription bundles on the front burner and make them a defining feature of their go-to-market strategy.

Bundle offerings will get even more ambitious as brands adopt flexible subscription technology

Rigid subscription technology is all most brands have at their fingertips right now, so experimentation and iteration within bundle offerings is far from the norm. But as flexible subscription technology becomes more accessible and widely adopted, we can expect to see more brands experimenting with a range of bundle models in pursuit of the best possible subscriber experience for their customers.

We predict that more brands will shift from fixed kits to build-your-own bundles to give subscribers more choice to keep things interesting, and prevent churn from product overstock. After all, flexible subscription technology makes them just as easy to get up and running as a fixed bundle.

Although they’re less common today, we predict that flexible subscription technology will encourage more brands to incorporate a rotating bundle model to prevent subscription fatigue and max out LTV through better subscriber retention.

Source: Anatta

Brands with premium bundle experiences will set a new bar in the subscription market

As it becomes easier for brands to experiment with their subscription bundle offering, a new bar for premium bundle experiences will emerge — and with it, subscriber expectations will start to shift.

Brands who finetune their bundle experience to be best-in-class will not only retain subscribers for longer. They’ll also have an easier time acquiring new subscribers because they’ll be known for the quality of experience — and flexibility — they offer in a historically rigid subscription bundle market.

And as brands continue to adopt flexible subscription technology, this prediction will likely always ring true. There will always be new customer expectations to meet.

And there will always be a new bar to be set.