Unlocking Growth in Direct Selling Subscriptions: 5 Insights from Ordergroove’s 2025 Survey

Nearly every direct selling brand offers subscriptions. But few are maximizing their potential, leaving behind meaningful recurring revenue and stronger customer relationships.

From direct selling brands like Plexus Worldwide, Herbalife, and JuicePlus+ to hundreds of retailers, Ordergroove powers experiences that turn repeat purchases into lasting relationships. Today, 11% of adult Americans have a subscription on our platform, giving us a front-row view of what drives retention and lifetime value.

In our 2025 State of Direct Selling Subscriptions Survey, we found that while adoption is strong, maturity is not. Here are three stats every executive should know:

- 53% of leaders say retention is their top subscription challenge. Churn, more than adoption or technology, is the biggest blocker to growth.

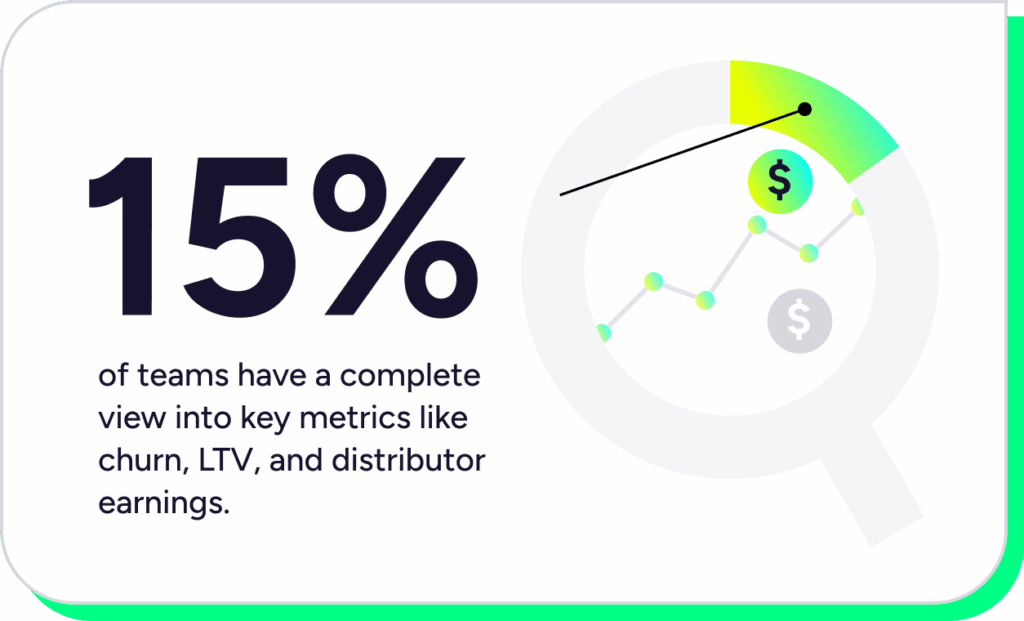

- Only 15% of teams have full visibility into churn, LTV, and distributor earnings. Most are flying blind when it comes to performance.

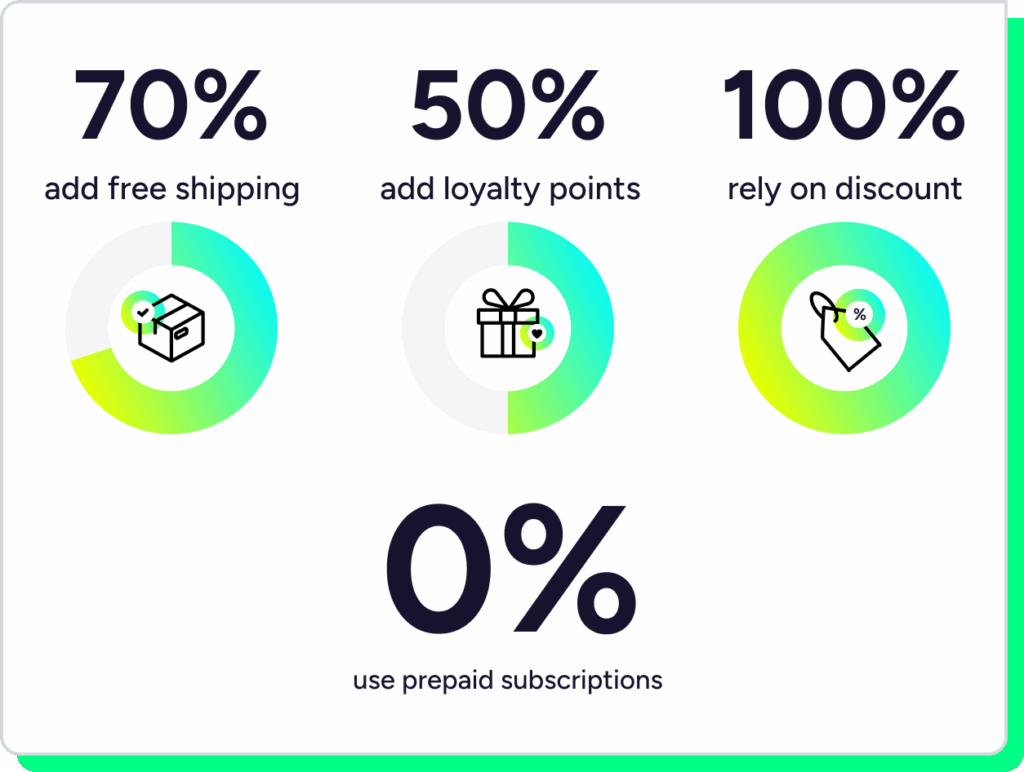

- 100% of brands rely on discounts, while 0% have adopted prepaid subscriptions. That’s a missed opportunity to double LTV and improve margins.

The bottom line: Subscriptions aren’t the problem — optimization is. The next wave of growth will come from brands that modernize retention, use data to drive smarter decisions, and build experiences that keep customers and their field engaged.

Wondering where to start? Our 2025 survey of direct selling leaders highlights five practical steps the fastest-growing brands are already taking.

1. Subscriptions are common, but aren’t competitive yet

Almost every direct selling brand now offers a subscription option, and according to our survey, almost half (46%) say it’s central to their business model.

Yet, most are still built on the basics like discounts and pause/skip functionality. Few offer modern features like product swaps, delivery flexibility, or prepaid packages that give customers control.

Takeaway: A set-it-and-forget-it subscription won’t cut it. Leading brands are designing frictionless, flexible experiences that feel personal, not transactional.

2. Retention is the biggest unlock

In our survey, 53% of executives said retaining subscribers is their toughest challenge. Across industries, the same pattern emerges: without the tools to engage and retain subscribers, churn steadily erodes recurring revenue.

Going beyond autoship with flexible incentives and seamless subscription management empowers both customers and distributors to build long-term relationships that strengthen retention.

Takeaway: Invest in retention with the same focus as acquisition. Every additional month a subscriber stays multiplies lifetime value.

3. Data visibility is the new growth advantage

Only 15% of teams have a complete view into key metrics like churn, LTV, and distributor earnings. Most track surface-level KPIs like subscriber counts or order volume without linking them to real financial outcomes.

Without unified analytics, finance and growth leaders can’t tune incentives, protect margins, or forecast accurately.

Takeaway: Visibility drives velocity. Modern analytics reveal what’s working, what’s not, and where to invest next.

4. Discounts dominate, but smarter incentives drive better results

Every brand in our survey (100%) relies on discounts to attract or retain subscribers. Most add free shipping (70%) or loyalty points (50%), but that’s where the strategy stops.

Prepaid subscriptions, which can double lifetime value, are almost nonexistent. So are bundles, milestone rewards, and surprise-and-delight perks that build loyalty.

Takeaway: Discounts win short-term conversions, not long-term relationships. Smarter incentives, like prepaid plans and bundles, create sustainable, high-margin growth.

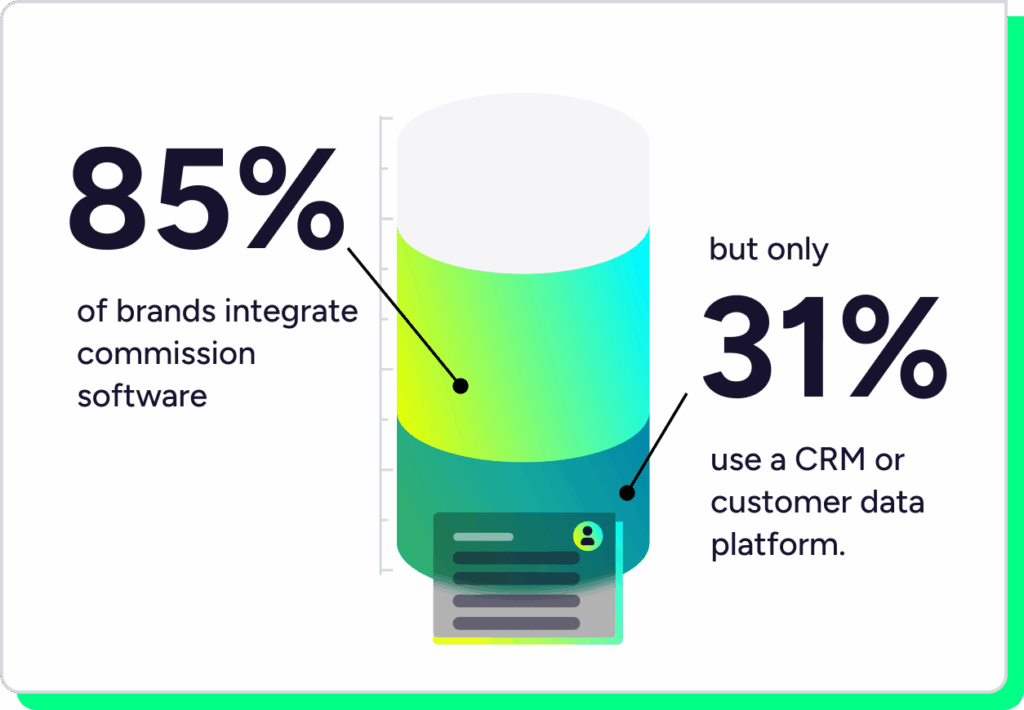

5. Tech stacks should support compensation and connection

85% of direct selling brands integrate with commission and back office platforms similar to Exigo and InfoTrax. Yet, only 31% have integrated a CRM or customer data platform, which are critical tools for understanding the customer journey.

To grow recurring revenue, direct selling leaders can complement their existing commission-based systems with tools that cultivate relationships and drive predictable, recurring revenue.

Takeaway: Rebalance your tech stack to prioritize the customer and distributor experience. Growth follows connection.

The bottom line: From recurring transactions to recurring relationships

Direct selling has embraced subscriptions, but most are still early in their journey. The next phase of growth will come from:

- Retention-first experiences that reduce churn through flexibility and personalization

- Smarter incentives like prepaid, bundles, and loyalty moments

- End-to-end visibility to understand what drives LTV and protect margins

- Integrated tech stacks that connect every customer touchpoint

At Ordergroove, we help direct selling brands including Herbalife, Plexus, and JuicePlus+ evolve from repeat orders to relationship-driven experiences. With 11% of U.S. adults now subscribed through Ordergroove-powered experiences, we see exactly what keeps customers loyal and distributors engaged.

Ready to evolve your subscription experience? Let’s talk.

Methodology: Survey conducted by Ordergroove at theJuice event on September 10, 2025, polling brand-side Direct Selling leaders to benchmark how subscriptions perform across experience, incentives, and core systems. Agency and technology platform responses were excluded from this analysis.