9 DTC subscription trends you can’t ignore in 2023

It’s no secret that eCommerce saw a surge in sales during the pandemic. According to the US Census Bureau, eCommerce sales jumped 43% in 2020 compared to 2019. Direct-to-consumer (DTC) brands were a major contributing factor in this meteoric growth. Not only did new DTC brands enter the market to meet consumer demand for frictionless experiences, but many large CPGs launched DTC eCommerce experiences to capitalize on eCommerce growth and build direct, one-to-one relationships with customers and increase margins.

However, with more DTC brands in the market (and more coming daily), acquisition costs have risen sharply as many of these brands are using the same playbook to acquire customers – social media advertising and influencer marketing. To overcome this pain, popular DTC brands are adopting subscriptions to build customer loyalty, improve retention, and balance out their customer acquisition costs compared to customer lifetime value.

The basic tenant of acquiring subscribers is a combination of value and convenience, but just as DTC competition is forcing brands to innovate to stand out, subscription experiences need to innovate as well. The best DTC subscriptions deliver delightful pre- and post-purchase experiences that make customers so deliriously happy that they never even consider canceling.

The pandemic may be over, but DTC subscriptions are still growing. If you’re a brand looking to offer subscriptions, check out our favorite customer experiences that revolve around the DTC subscription model. Follow their examples to acquire subscribers and increase customer lifetime value.

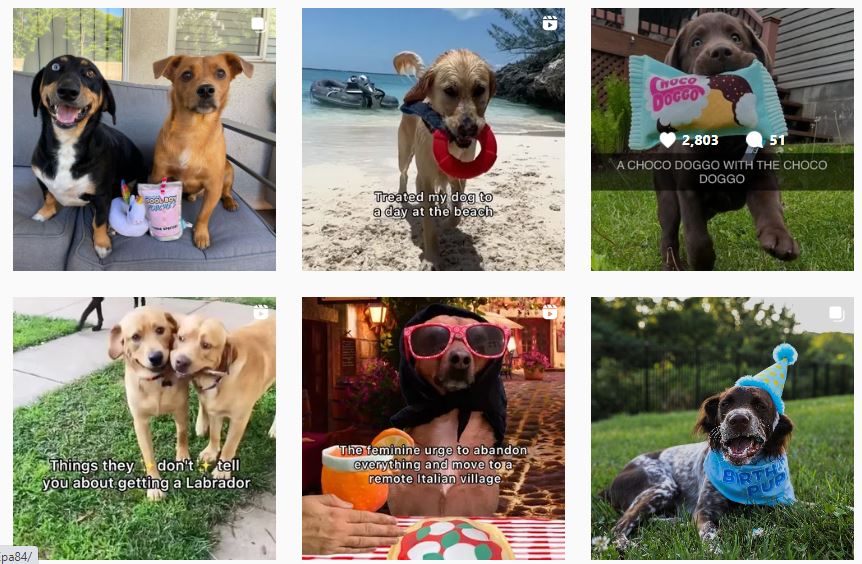

1. BarkBox: Let customers promote your subscription with UGC

BarkBox sells themed subscription boxes for dogs. While branded content plays a significant role in their marketing efforts, they also place a premium on content generated by customers.

Otherwise known as user-generated content (UGC), a recent report by Stackla reveals that 59% of consumers consider UGC the most authentic — in other words, trustworthy — type of content. UGC is almost six times more impactful in driving purchase decisions than influencer content.

BarkBox has an ongoing promotion where they encourage customers to post photos on Instagram of their dogs with BarkBox toys and treats. If customers tag their photos with #barkboxday, BarkBox will post the best ones on its UGC-only account @bark. The account boasts 440,000 followers, and a recent post generated 4,000+ likes and 80+ comments.

Barkbox realizes that it’s an investment of time for a customer to create and post UGC. No matter how much customers love their dogs, customers won’t participate unless they’re equally passionate about the subscription experience.

Take Barkbox’s product recommendations page. They personalize the page with the name of the customer’s dog, its age and breed, and make it a cinch to add the products to upcoming shipments. Plus they offer a discount on certain products if customers make them recurring.

Image source: Private BarkBox account

Growing a follower base on Instagram — or any other social media platform — takes time, especially a follower base willing to take the time to create UGC. Promote your account across your website and to your email list, experimenting with different contests to spur UGC creation.

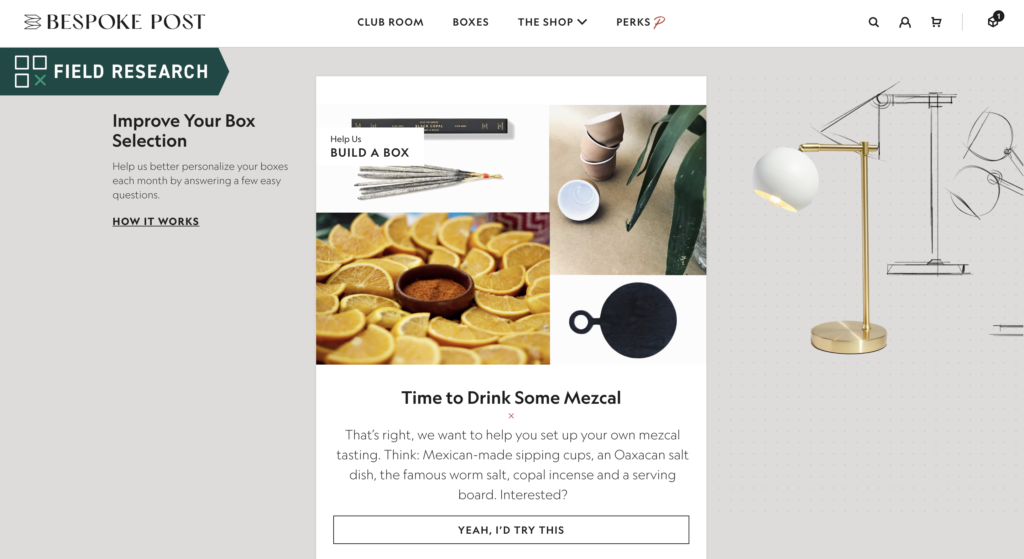

2. Bespoke Post: Empower customers to create a better eCommerce subscription experience

Bespoke Post‘s highly original products and themed bundles are a powerful lure for subscribers.

But it’s their post-purchase experience that builds customer anticipation for future shipments. It’s one thing to recommend products based on previous purchases, but it’s something else to recommend products customers tell you they actually want.

After enrolling in Bespoke Post, subscribers can rate potential box concepts. The DTC subscription brand uses this information to make decisions on futures boxes – from what goes into them to product design.

Image source: Personal subscription account

A 2021 McKinsey study found that 42% of subscribers canceled due to a lack of “new or fun items or experiences.” So why not leave it to the customer to decide what “new” or “fun” means?

For startups wishing to follow Bespoke Post’s themed approach to subscription boxes, be mindful that it can be difficult to come up with enough creative themes to keep customers interested over time.

As long as you’re confident in the supply chain for the products you suggest, Bespoke Post’s strategy can be a powerful way to keep subscribers engaged.

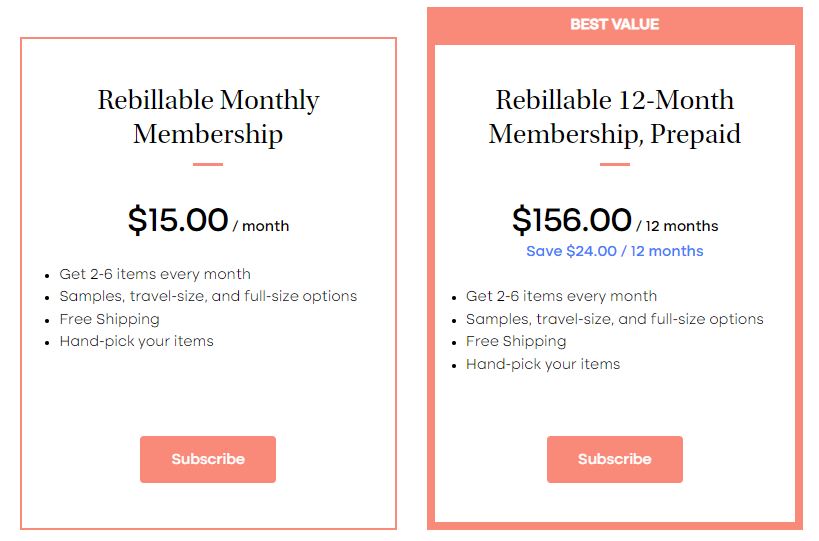

3. Birchbox: Encourage subscriber longevity with prepaid enrollments

Birchbox is a pioneering beauty DTC subscription brand that upsells customers to a year-long subscription using perceived value.

A monthly subscription is $15. But a subscription paid annually is $13 per month for the same benefits. The goal is for the customer to pay more upfront in exchange for greater value.

Birchbox is happy to offer a slightly lower monthly price point to take advantage of the annual subscription’s higher cash flow. Plus, they have a year to nurture the customer relationship in the hopes of avoiding a cancellation when the subscription comes up for renewal.

If you’re unable to upsell via a prepaid subscription, consider upselling using product recommendations.

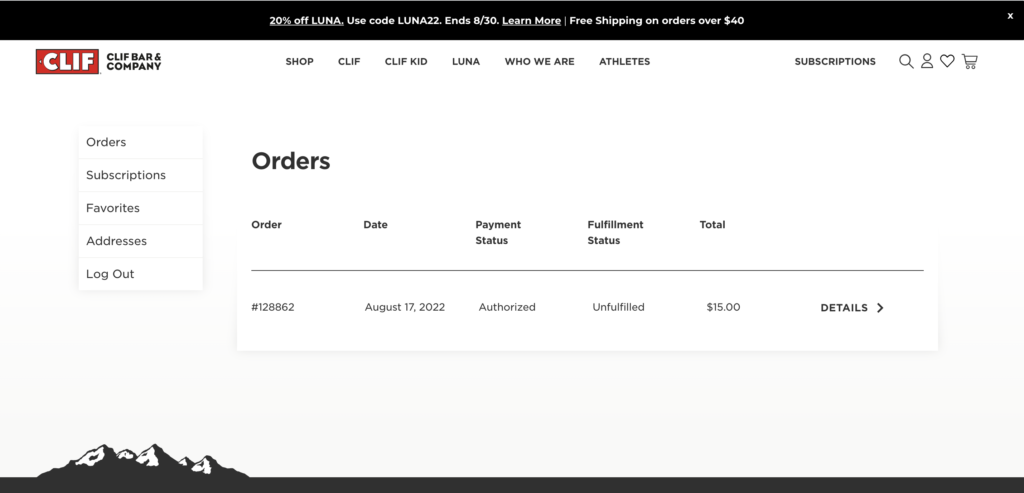

4. Clif Bar: Emphasize subscriber control and convenience

The convenience and flexibility of Clif Bar‘s subscription experience have made them popular among fitness enthusiasts. But given the competition, Clif Bar’s subscription management interface has set their brand apart.

A subscription management interface is a dashboard where subscribers take control of their shipments and membership. Clif Bar’s portal pulls together key actions in an intuitive user interface, from pausing a subscription (rather than canceling it) to changing the date of a shipment.

Image source: Personal subscription account

Here at Ordergroove we found that subscribers last 135% longer when they can skip an order and 71% longer when they can swap a product.

Knowing that the portal is a frequent stop for subscribers, Clif Bar uses it to encourage customers to add to their upcoming orders. They include the incentive of a 10% discount.

5. Dollar Shave Club: Use content to make your subscription about more than recurring shipments

Dollar Shave Club‘s DTC subscription model blends the value of their razors with engaging content designed to make mundane bathroom chores like shaving more enjoyable. Their content is less about “How to choose the right razor for your face” and more about “Here’s a three-to-four-minute podcast about an interesting fact that you can think about while you shave.”

Why the emphasis on witty, fun content? Because according to Parse.ly’s 2022 Content Matters Report, 43% of marketers said that content designed to “retain and expand existing customers” helped drive revenue.

Of course, Dollar Shave Club uses their weekly magazine to recommend products subscribers might enjoy. But they do so in a tongue-in-cheek manner that never feels too “salesy.”

The reality is there’s only so much you can do from a product standpoint to make deodorant and razors exciting. Dollar Shave Club realized as early as 2014 that content would become one of their great differentiators.

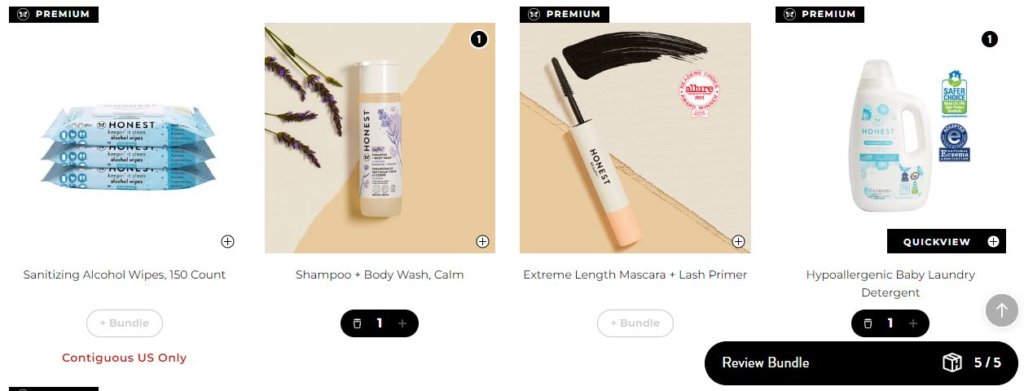

6. The Honest Company: Incentive bundling to increase average order value (AOV)

Like Bespoke Post, The Honest Company balances traditional eCommerce with a subscription experience. But they have packed so much value into their subscriptions — especially in their bundling experience — that customers can’t help but take notice.

One of Honest’s strongest value propositions is their variety of wellness, beauty, and baby products. The same McKinsey study mentioned above found that 35% of subscribers stick around because a brand has a “good variety of items or experiences.”

With a few clicks, subscribers can assemble a five-item bundle from Honest’s 130 products for a flat rate of $54.95. That’s a savings of $10 from what one-off buyers pay. Plus, subscribers get free shipping.

If customers tire of any product in their subscription bundle, they can substitute a new product before their next shipment goes out.

To achieve such a well-integrated subscription bundling experience, it’s important to choose your eCommerce subscription platform carefully.

Providers such as Ordergroove partner with the top eCommerce platforms like Shopify, Salesforce, and BigCommerce to offer a seamless experience you can track and analyze. Learn which subscription prompts lead to the most enrollments and which need an improved call to action.

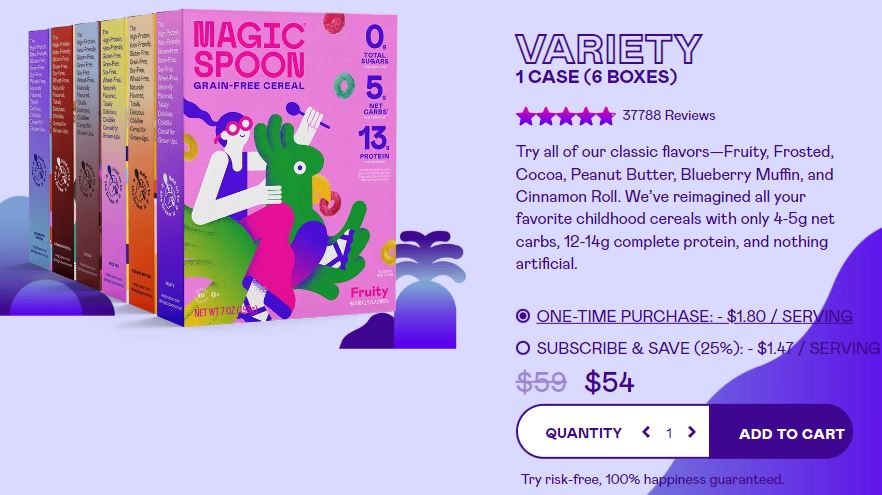

7. Magic Spoon: Try without risk

Magic Spoon tries to capture the flavors of favorite — and sugary — kids’ cereals in a much healthier way. Whether customers enroll in a subscription program or purchase a one-time four-pack of cereal, the company offers a full refund on the first order if the customer isn’t satisfied.

Magic Spoon posts a notice of their “try risk-free” policy at the point of purchase, as well as in a detailed FAQ.

A free trial costs the business the product and shipping fees. It’s only a worthwhile tactic if the customers who don’t request a refund are able to pay for the ones who do — without unacceptably shrinking profit margins.

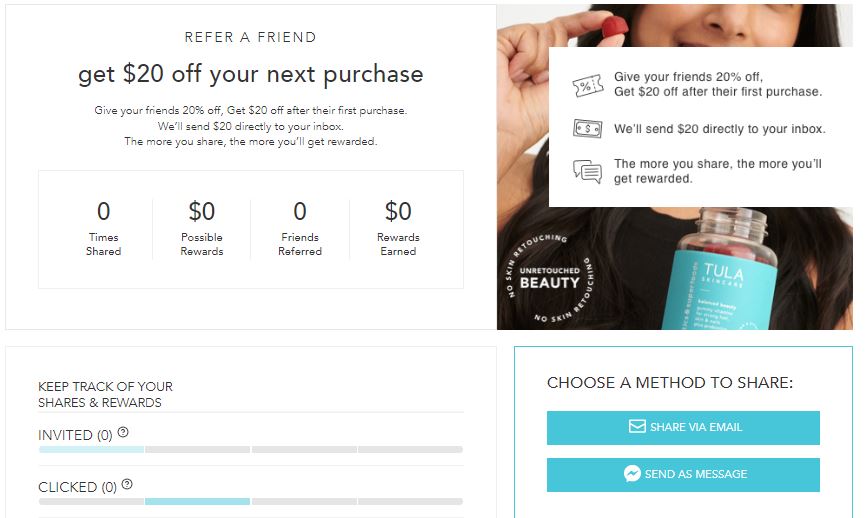

8. TULA: Put customer communications front and center

TULA is an online skincare brand that emphasizes SMS messaging to keep their customer base informed. SMS messaging isn’t new, and it’s not replacing email. But it’s a powerful way to let subscribers know about upcoming shipments and spread the word about your brand.

According to SMS platform Attentive, close to 96% of marketers say text messaging helps drive more revenue. TULA takes this to heart by including an SMS signup option in their footer.

With customer acquisition costs on the rise, TULA also uses SMS to help existing customers push a post-purchase referral program to their friends and family.

Image source: Personal subscription account

In Influitive’s 2022 State of Customer Marketing report, 78% of respondents call customer referrals “very” or “extremely” effective marketing tactics. With SMS open rates hovering at around 99%, it’s the perfect way to promote such a valuable acquisition source.

For subscribers already enjoying special product discounts, referrals can add even more value to their experience. In TULA’s case, what better way to increase average order value than giving subscribers an extra $20 to spend?

A referral program starts with finding the right plugin. Refersion integrates with Shopify, BigCommerce, Magento, and other eCommerce platforms. It also works with Attentive to send SMS notices at a cadence you set.

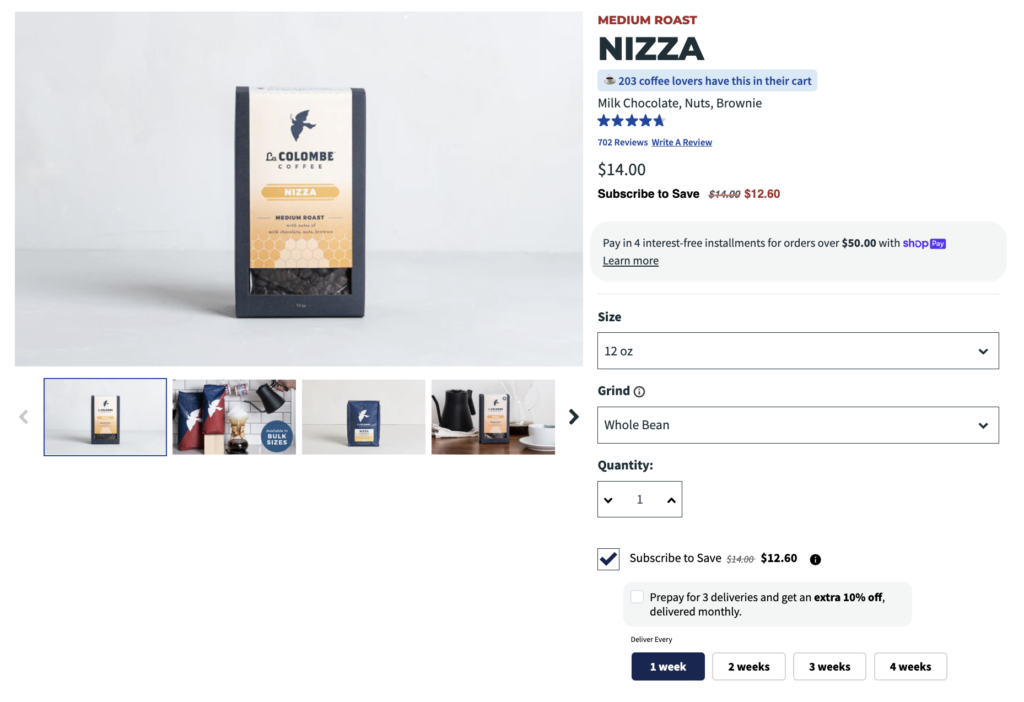

9. La Colombe: Boost CLV with prepaid subscriptions

It’s been a tumultuous year for DTC brands. Customer acquisition costs are rising, brand loyalty is low, and consumers and brands alike have been impacted by inflation. Brands who want to thrive in 2023 and beyond are doubling down on their efforts to drive great customer lifetime value – namely through prepaid subscriptions.

Prepaid subscriptions allow consumers to subscribe to your product for a longer term in exchange for a steeper discount. Internal Ordergroove data shows that prepaid subscriptions can generate four times the CLV of traditional pay-as-you-go subscriptions.

Specialty coffee roaster, La Colombe, is a fantastic example of a brand successfully using prepaid subscriptions. When enrolling in La Colombe’s subscription experience, consumers have the option to prepay for three deliveries and receive an additional 10% off their order. This is on top of an initial 10% discount, free shipping, and early access to La Colombe products.

Prepaid subscriptions do more than drive CLV. They unlock upfront subscription revenue, enabling you to forecast better – which is imperative in volatile times like today. Prepaid subscriptions enable you to meet consumers where they are in their relationship with your DTC subscription brand. New subscribers can enroll in a monthly subscription, while your most loyal subscribers can enroll for longer.

Pay-as-you-go subscriptions are essential to combat market changes through stable revenue streams, but pre-paid subscriptions add a layer of resilience through supercharged CLV growth.

Optimize the DTC customer experience with subscriptions

The opportunities to craft a high-performing subscription experience that delights are endless, but in order to stand out and beat the growing competition, DTC brands need to focus on building great experiences coupled with the right product, messaging, content, and technology to power it. Together, they can create a pre- and post-purchase eCommerce experience that leads to customer retention — and an improved bottom line.

To learn more about how Ordergroove can enhance your direct-to-consumer brand with a subscription experience, click here for a free demo.